Welcome to Trading for Beginners, where opportunity and strategy come together in your trading journey.

1 – Understanding the Basics of Trading

Trading involves buying and selling financial instruments such as stocks, currencies, options, or commodities with the goal of making a profit. Before diving into specific trading types, it’s essential to grasp some fundamental concepts.

1.1 – What is trading?

Trading is the process of buying and selling financial instruments, such as stocks, cryptocurrencies, forex, commodities, and more, with the aim of generating profits from price movements. It is a fundamental activity within the financial markets, where traders capitalize on market fluctuations to take advantage of opportunities.

At its core, trading involves making decisions based on market analysis, economic indicators, company news, and other factors that influence the value of the traded instruments. Traders employ various strategies and techniques to predict price movements and make informed trading decisions.

To be a successful trader, you need to know things, have skills, and be disciplined. You should understand how to handle risks, decide on the right sizes for your positions, and deal with the way you think and feel when you’re trading. Also, it’s important to use tools that help you analyze data, look at the basics, and keep up with what’s happening in the market.

It’s important to note that trading involves risks, and not all trades will be profitable. It is crucial to approach trading with a realistic mindset and manage risks effectively. Beginner traders are encouraged to start with small positions, educate themselves, and gradually increase their trading experience.

1.2 – Trading for Beginners – The importance of market analysis

Market analysis plays a crucial role in trading. By studying market trends, patterns, and indicators, traders can identify potential opportunities and predict price movements.

Fundamental analysis focuses on analyzing financial statements, news, and economic factors, while technical analysis examines price charts and patterns.

1.3 – Key trading terminologies

To navigate the trading world effectively, it’s essential to familiarize yourself with key terminologies such as:

- Bull and bear markets

- Long and short positions

- Stop-loss and take-profit orders

- Volatility and liquidity

- Margin and leverage

2 – Different Types of Trading

Trading offers various options, each with its own strategies. Let’s check out the top ones for beginners:

- Day trading for beginners

Day trading involves executing trades within a single day to take advantage of short-term price fluctuations. Traders who engage in day trading closely monitor the market, utilizing technical analysis tools and strategies.

- Options trading for beginners

Options trading gives traders the right, but not the obligation, to buy or sell an asset at a predetermined price within a specific timeframe. This flexible trading approach allows traders to profit from both rising and falling markets.

- Forex trading for beginners

Forex trading focuses on buying and selling currencies. As the largest and most liquid market globally, forex offers traders ample opportunities for profit. Understanding currency pairs, leveraging leverage, and utilizing risk management techniques are vital in forex trading.

- Stock trading for beginners

Stock trading involves buying and selling shares of publicly traded companies. Traders analyze company performance, market trends, and other factors to make informed decisions. Stock trading can be done through traditional brokers or online platforms.

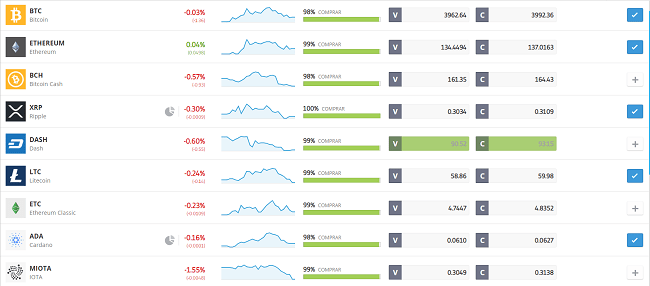

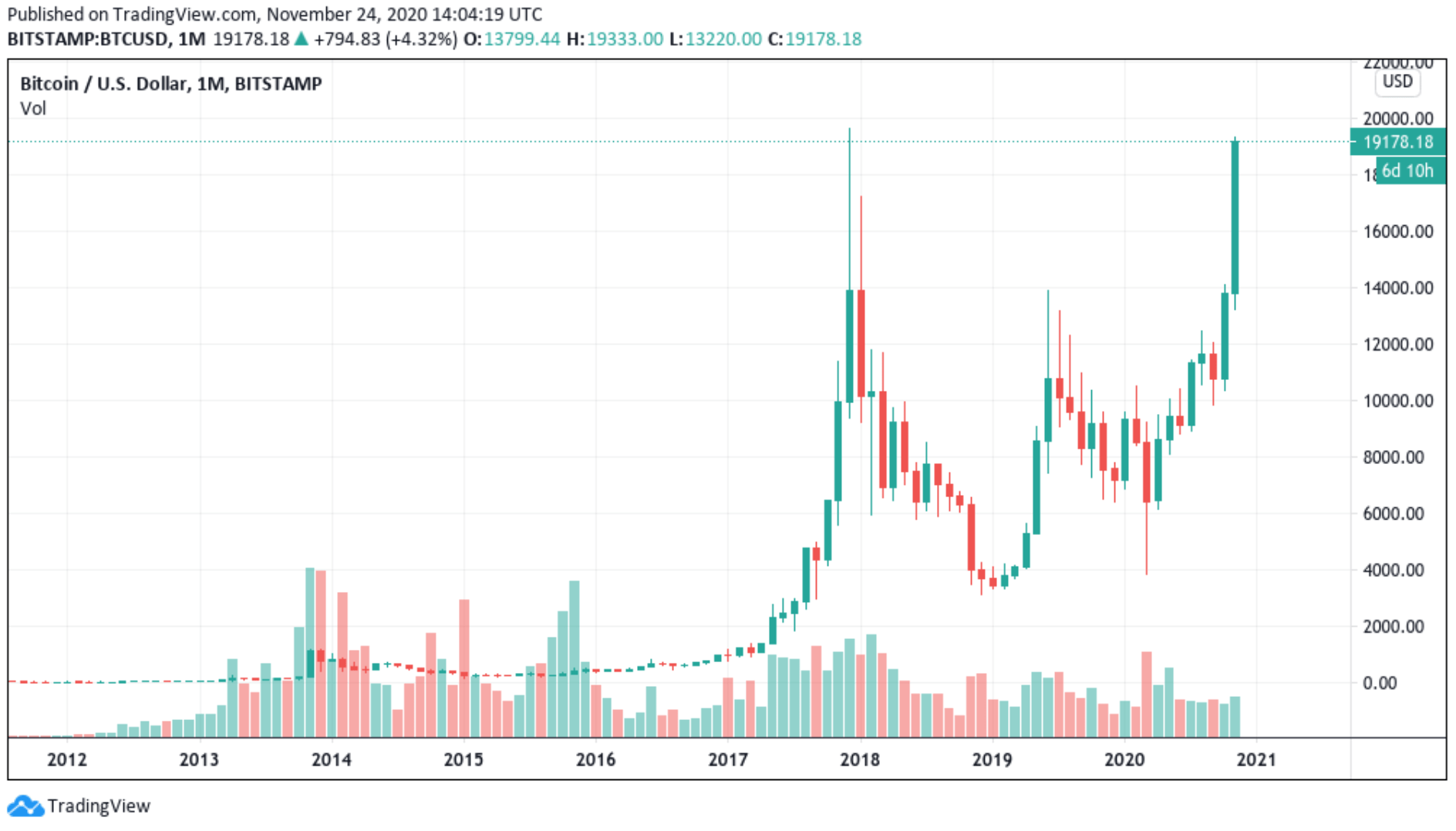

- Cryptocurrency trading for beginners

Cryptocurrency trading is about buying and selling digital currencies such as Bitcoin, Ethereum, or Litecoin. Traders watch cryptocurrency websites, study price graphs, and keep up with market news to find chances to make money in this fast-changing market.

- Futures trading for beginners

Futures trading revolves around contracts that obligate traders to buy or sell assets at a predetermined price on a specified future date. Traders speculate on the price movement of commodities, currencies, or indices.

- CFD trading for beginners

Contract for Difference (CFD) trading enables traders to speculate on the price movements of various financial instruments without owning the underlying assets. It offers flexibility and the potential for profit in both rising and falling markets.

3 – Getting Started with Online Trading

To embark on your trading journey, you need to set up an online trading account and choose a reliable trading platform.

3.1 – Choosing a reliable trading platform

Selecting the right trading platform is crucial for a seamless trading experience. It’s essential to consider various factors to ensure the platform meets your needs and preferences. Here we will introduce eToro, one of the popular trading platforms, and discuss its pros and cons. Additionally, we will provide a table summarizing the fees associated with using eToro.

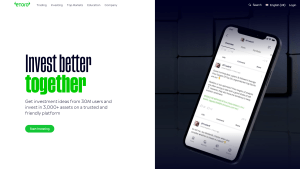

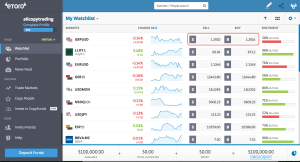

eToro: The Ideal User-Friendly Trading Platform for Beginners

eToro is a well-established online trading platform that caters to both beginner and experienced traders. Known for its user-friendly interface and social trading features, eToro offers a unique trading experience.

With eToro, users have access to a wide range of markets, including stocks, cryptocurrencies, forex, commodities, and more. The platform combines innovative technology with a user-friendly design, making it easy for beginners to navigate and execute trades.

eToro Fee Summary Table

Here’s a summary of the fees associated with using eToro:

|

Fee Type |

Description |

|

Spreads |

eToro charges spreads on trades, varying by asset class and market conditions. |

|

Overnight Fees |

Holding positions overnight may incur fees known as overnight rollover fees. |

|

Withdrawal Fees |

eToro charges a withdrawal fee for transferring funds from your trading account. |

|

Inactivity Fee |

An inactivity fee may be applied for dormant accounts that have been inactive for a specific period. |

Please note that fees may vary and it’s advisable to visit eToro’s official website for the most up-to-date information on fees and charges.

Choosing the right trading platform is a crucial step in your trading journey. Consider your trading goals, preferred markets, ease of use, and associated fees when evaluating platforms like eToro.

Pros of eToro

Pros of eToro

- User-friendly interface: eToro’s platform is intuitive and user-friendly, making it easy for beginners to get started with trading. The platform provides a simple and visually appealing interface that allows users to navigate various markets effortlessly.

- Social trading features: One of eToro’s standout features is its social trading functionality. Users can interact with and learn from a community of traders. They can also copy the trades of successful traders, automatically replicating their positions in real-time.

- Wide range of markets: eToro offers an extensive selection of markets, including stocks, cryptocurrencies, commodities, forex, and more. This allows users to diversify their trading portfolio and explore different investment opportunities.

- CopyTrading: eToro’s unique CopyTrading feature enables users to automatically replicate the trades of successful traders. This feature is especially beneficial for beginners who can learn from experienced traders and potentially generate profits while they develop their trading skills.

- Regulated and secure: eToro is a reputable platform that is regulated by top-tier financial authorities. This ensures a higher level of security and trust for users, as the platform adheres to stringent regulatory standards.

Cons of eToro

Cons of eToro

- Limited research and analysis tools: While eToro provides basic charting and analysis tools, it may be lacking in advanced research features compared to other platforms. Traders who heavily rely on in-depth analysis may find eToro’s tools to be somewhat limited.

- Higher fees on certain transactions: While eToro offers commission-free trading on stocks and ETFs, it compensates for this through wider spreads and overnight fees for other assets. Traders should carefully consider the associated costs before engaging in specific trades.

- Limited customization options: Advanced traders who prefer customizing their trading experience may find eToro’s platform to be less flexible in terms of advanced order types and trading algorithms.

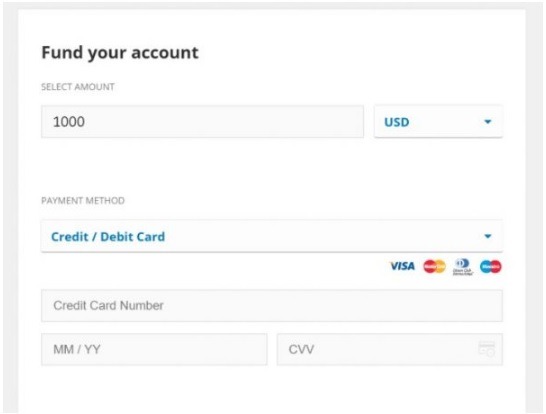

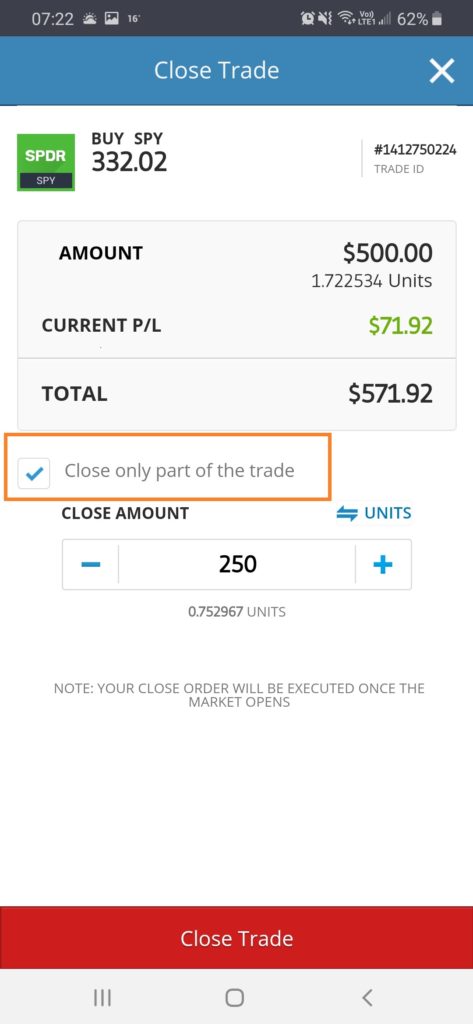

3.2 – Setting up your trading account

After choosing a platform, sign up and create your trading account. Provide the required information, complete any verification processes, and fund your account with the desired amount.

3.3 – Understanding risk management

Risk management is essential to protect your trading capital. Set reasonable risk limits, diversify your portfolio, and use stop-loss orders to limit potential losses.

4 – Trading for Beginners – Mastering the Fundamentals

To become a successful trader, it’s vital to master the fundamental aspects of trading. Let’s delve into the essential knowledge you need.

4.1 – Technical analysis for beginners

Technical analysis involves examining historical price data and using various indicators and chart patterns to predict future price movements. Learn to interpret candlestick charts, trend lines, moving averages, and oscillators.

4.2 – Fundamental analysis for beginners

Fundamental analysis focuses on evaluating the intrinsic value of an asset by studying financial statements, economic factors, industry trends, and company news. Develop skills in assessing balance sheets, income statements, and economic indicators.

4.3 – Developing a trading strategy

A well-defined trading strategy is crucial for consistent profitability. Consider factors such as your risk tolerance, trading goals, time horizon, and preferred trading style. Test your strategy in different market conditions and refine it based on your results.

5 – Trading for Beginners – Navigating the Stock Market

The stock market offers exciting opportunities for traders. Understanding its dynamics and implementing effective strategies can lead to success.

5.1 – Introduction to the stock market

The stock market is a fascinating and powerful part of the world’s money system. It’s where people and companies meet to buy and sell parts of public businesses. Knowing the basics of the stock market is important for both investors and traders because it lets you make money and be part of the economy. As we go further into this guide for beginners on trading, you’ll learn more about how the stock market works and how to use it well.

By gaining a solid foundation of knowledge about the stock market, you’ll be better equipped to navigate its complexities and make informed investment decisions.

Whether you’re a novice investor looking to dip your toes into the market or a seasoned trader seeking to expand your knowledge, this section will serve as a valuable resource. So, let’s embark on this educational journey to uncover the fascinating world of the stock market and empower ourselves with the knowledge needed for success.

5.2 – Tips for successful stock trading

To thrive in the world of stock trading, it’s crucial to approach it with discipline and knowledge. In this section, we provide valuable tips to boost your success. Set realistic goals, conduct thorough research, practice patience, diversify your portfolio, manage risks, and stay informed with market news and trends. By following these tips, you’ll be on your way to becoming a more successful stock trader.

-

Set Realistic Goals: Define achievable goals for your stock trading journey. Having clear objectives helps you stay focused and motivated.

-

Conduct Thorough Research: Before making any investment, conduct thorough research on the stocks you’re interested in. Analyze company financials, industry trends, and market conditions to make informed decisions.

-

Practice Discipline: Develop a disciplined approach to stock trading. Stick to your trading plan, follow predetermined strategies, and avoid impulsive or emotional decisions.

-

Be Patient: Stock trading requires patience. Avoid the temptation to chase short-term gains and focus on long-term profitability. Remember that successful trading takes time and perseverance.

-

Diversify Your Portfolio: Diversification is crucial to manage risk. Spread your investments across different sectors, industries, and asset classes to minimize the impact of any single stock’s performance on your portfolio.

-

Manage Risks: Implement proper risk management techniques. Set stop-loss orders to limit potential losses and use position sizing strategies to control the amount of capital allocated to each trade.

-

Stay Updated with Market News and Trends: Stay informed about market news, economic indicators, and company updates that may impact your investments. Continuously monitor market trends to make well-timed trading decisions.

By following these tips, you can develop a disciplined and successful approach to stock trading. Remember to adapt your strategies as market conditions change and always prioritize risk management in your trading endeavors.

5.3 – 5 Top Global Trading Platforms

When it comes to online stock trading, beginners need a reliable platform that provides a user-friendly experience, a wide range of stocks, real-time market data, and educational resources. Here are the top 5 Global Trading Platforms that are well-suited for beginners:

-

eToro: eToro stands out as a beginner-friendly platform, offering a unique social trading experience where users can interact with and learn from other traders. It provides a wide range of stocks, real-time market data, and educational resources to support beginners.

- Plus500: Plus500 provides an extensive product range of CFDs to customers in over 50 countries, encompassing CFDs on a variety of assets, such as forex, stock indices, individual shares, commodities, ETFs, options, and cryptocurrencies (availability subject to regulatory compliance).

- Robinhood: Robinhood gained popularity for its commission-free trading and user-friendly mobile app. It offers a limited selection of stocks but is an excellent option for beginners seeking simplicity.

- TD Ameritrade: TD Ameritrade’s powerful trading platform, thinkorswim, provides a comprehensive set of tools and educational resources. It caters to beginners with a wide range of stocks and a user-friendly interface.

- IG: IG offers a user-friendly platform with access to stocks, forex, indices, and commodities. It provides educational resources and a customizable interface for beginners.

When picking an online stock trading website, check out what they offer, how much they charge, their customer help, and if they have helpful learning stuff. Think about what you want to achieve with your trading and what you like, so you can find the website that suits you best as a new investor.

The risk warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89% of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

6 – Forex Trading for Beginners

Forex, short for foreign exchange, is the largest and most liquid financial market globally. It involves the buying and selling of currencies, with the aim of profiting from the fluctuations in exchange rates. Forex trading provides opportunities for individuals, financial institutions, and businesses to participate in the global economy and speculate on currency movements.

In forex trading, currencies are always traded in pairs, such as the EUR/USD (Euro/US Dollar) or GBP/JPY (British Pound/Japanese Yen). The forex market operates 24 hours a day, five days a week, allowing traders to engage in trading activities at their convenience. The market is decentralized, meaning there is no central exchange, and trading occurs electronically over-the-counter (OTC), facilitated by a network of banks, financial institutions, and individual traders.

Forex trading offers several advantages, including high liquidity, allowing for quick and seamless execution of trades, and the ability to profit from both rising and falling markets. Traders can access a wide range of currency pairs, giving them the flexibility to trade based on their market analysis and strategies. However, it’s important to note that forex trading involves risks, including currency volatility and leverage, which can amplify both gains and losses. Developing a solid understanding of market analysis, risk management, and trading strategies is crucial for success in the forex market.

7 – Cryptocurrency Trading beginners

As beginners step into the world of cryptocurrency trading, they need to build a strong knowledge base. This means understanding the basics of blockchain technology, getting a grip on decentralized finance (DeFi), and learning what factors affect cryptocurrency prices. It’s also important to get familiar with different types of cryptocurrencies, how they’re used, and what’s happening in the overall market. This knowledge will help beginners make smart trading decisions.

Now, when it comes to cryptocurrency trading, there are pros and cons. On one hand, the market’s ups and downs can lead to profits. On the other hand, it can be risky. With this awareness, let’s shift our focus to explore some trading strategies that are great for beginners.

We’ve talked about being careful and doing research in cryptocurrency trading. Now, let’s look at specific trading strategies that work well for newcomers. With a solid understanding of the basics and a commitment to managing risks wisely, beginners can confidently navigate the ever-changing cryptocurrency trading world.

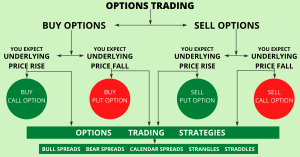

8 – Trading for Beginners – Understanding Options Trading

Options trading can provide flexibility and hedging opportunities. Learn the basics of options trading and how to leverage them effectively.

8.1 – Basics of options trading

Understand the concepts of calls and puts, option contracts, and strike prices. Explore different options strategies, such as buying and selling options, and learn how to assess risk and potential rewards.

8.2 – Common options trading strategies

Discover popular options trading strategies, including covered calls, protective puts, and straddle strategies. Learn how to apply these strategies based on your trading objectives and market conditions.

8.3 – Risks and rewards of options trading

Understand the risks associated with options trading, such as time decay, volatility, and potential loss of the entire investment. Evaluate the rewards and benefits of options trading, including leverage and potential for higher returns.

9 – Trading for Beginners – Embracing Day Trading

Day trading requires discipline and the ability to make quick decisions. Learn the essentials of day trading and how to develop a successful day trading routine.

9.1 – What is day trading?

Understand the concept of day trading and its unique characteristics. Learn about the importance of technical analysis, short-term trading strategies, and the psychology of day trading.

9.2 – Essential day trading techniques

Explore popular day trading techniques, such as scalping, momentum trading, and breakout trading. Learn how to identify patterns, set entry and exit points, and manage risk in fast-paced market environments.

9.3 – Building a day trading routine

Develop a structured day trading routine that includes pre-market preparation, trading plan development, active trading hours, and post-market analysis. Create a routine that suits your trading style and maximizes your chances of success.

10 – Trading for Beginners – Exploring Futures Trading

Futures trading allows traders to speculate on the future price movements of commodities, currencies, or indices. Discover the essentials of futures trading and how to navigate this dynamic market.

10.1 – Introduction to futures trading

Learn about futures contracts, their features, and the role of futures exchanges. Understand how futures trading can provide hedging opportunities and exposure to various asset classes.

10.2 – How futures contracts work

Explore the mechanics of futures contracts, including contract specifications, expiration dates, and margin requirements. Understand the concept of long and short positions and how futures prices are determined.

10.3 – Benefits and risks of futures trading

Evaluate the benefits of futures trading, such as liquidity, leverage, and the ability to profit from both rising and falling markets. Understand the risks associated with futures trading, including price volatility and potential margin calls.

11 – Trading for Beginners – Building Your Trading Knowledge

Continuous learning is key to improving your trading skills. Discover valuable resources and learning opportunities to enhance your trading knowledge.

11.1 – Learning resources for beginners

Explore a variety of learning resources, such as books, online courses, webinars, and trading forums. Find reputable sources that offer comprehensive educational materials tailored to beginners.

11.2 – Books, courses, and online tutorials

As we emphasize the value of investing in your trading education, let’s explore some highly recommended resources. These include books, courses, and online tutorials. These resources cover essential topics such as trading strategies, technical analysis, fundamental analysis, and risk management. They provide you with the opportunity to gain valuable insights from experienced traders and industry experts.

12 – Evaluating Trading Tools and Platforms

Selecting the right trading tools and platforms can significantly enhance your trading experience. Explore essential tools and platforms suitable for beginners.

12.1 – Essential tools for beginners

Discover essential tools such as market scanners, stock screeners, economic calendars, and news aggregators. These tools can help you identify trading opportunities, analyze market data, and stay updated with the latest news.

12.2 – Top trading platforms for beginners

Explore user-friendly trading platforms that offer a wide range of trading instruments, intuitive interfaces, and educational resources. Consider factors such as pricing, platform stability, customer support, and available features.

13 – Risk Management and Psychology

Successful trading requires effective risk management and an understanding of the psychological aspects of trading. Learn how to manage risks and control your emotions.

13.1 – The importance of risk management

Understand the significance of risk management in trading. Learn how to set risk limits, use stop-loss orders, and manage position sizes to protect your trading capital.

13.2 – Emotions and psychology in trading

Recognize the impact of emotions on trading decisions and learn strategies to control them. Develop discipline, patience, and a rational mindset to navigate the ups and downs of the market.

14 – Trading for Beginners – Practicing with Demo Accounts

Now that we’ve explored the importance of demo accounts as a risk-free practice environment, let’s delve deeper into their benefits and the key factors for choosing the right demo account.

14.1 – Benefits of demo trading

Explore the advantages of demo accounts, including the ability to test trading strategies, familiarize yourself with trading platforms, and gain practical experience without risking real money. Additionally, as we continue with this ‘Trading for Beginners’ guide, we’ll delve further into the benefits and practicalities of using demo accounts in your trading journey.

14.2 – Choosing the right demo account

Select a demo account that replicates real-market conditions and offers a wide range of trading instruments. Look for features such as real-time data, customizable settings, and the ability to track your trading performance.