Note: Before reading this article about Buy Tether!

We always strive to provide our customers with the latest news and information about finance, stocks and cryptocurrencies. However, we would like to point out that YOU SHOULD NOT take any content on our site as financial advice.

What is Tether?

What is Tether?

Tether, often referred to as USDT, is a stablecoin in the cryptocurrency market. It is designed to maintain a stable value by pegging its price to a reserve of real-world assets, primarily the US dollar. Tether provides a bridge between traditional fiat currencies and digital assets, offering stability and liquidity for traders and investors. Let’s take a closer look at the history and price performance of Tether.

History of Tether

The coin was launched in 2014 by a company called Tether Limited. Its initial goal was to address the need for a stable cryptocurrency that could facilitate seamless transactions and preserve value in the volatile crypto market. Over the years, Tether has gained widespread adoption and has become one of the leading stablecoins in terms of market capitalization.

Price History

Tether’s price is designed to remain relatively stable at around $1 per token, as it is backed by an equivalent reserve of fiat currency. This stability has made Tether a popular choice for traders who want to mitigate the risks associated with price fluctuations in other cryptocurrencies. However, it’s important to note that Tether’s price can experience slight deviations due to market dynamics and demand.

How Does Tether Work?

Tether operates on the blockchain technology of various platforms, including Bitcoin, Ethereum, and Tron. The supply of Tether tokens is managed through a process called “minting,” where new tokens are issued when the corresponding amount of fiat currency is deposited into Tether’s reserves. The transparency of Tether’s reserve holdings is a critical factor that ensures the stability and trustworthiness of the coin.

Why Buy Tether?

Tether offers several advantages that make it an attractive choice for investors and traders:

- Stability: Tether’s peg to the US dollar provides stability, reducing the impact of price volatility commonly associated with other cryptocurrencies.

- Liquidity: Tether is widely accepted and traded on various cryptocurrency exchanges, providing ample liquidity for users.

- Fiat Currency Exposure: Tether allows users to hold a digital asset with a value equivalent to traditional fiat currencies, making it a convenient medium for transferring value.

- Trading Efficiency: Tether can be used as a base currency for trading pairs on exchanges, enabling seamless and efficient trading between different cryptocurrencies.

Despite these advantages, it’s essential to consider the risks associated with Tether before making an investment decision.

How to Buy Tether Safely

When buying Tether or any other cryptocurrency, safety should be a top priority. Here are some key considerations to ensure a safe buying experience:

- Choose reputable and regulated cryptocurrency exchanges that offer Tether.

- Enable two-factor authentication (2FA) for enhanced security.

- Use secure and private wallets to store your Tether tokens.

- Keep your private keys and passwords secure and confidential.

- Stay vigilant against phishing attempts and scams.

Risks of Buying Tether

While Tether offers stability and convenience, it’s important to be aware of potential risks associated with the cryptocurrency:

- Regulatory Risks: Tether’s regulatory environment may change, which could impact its operations and value.

- Counterparty Risks: Tether’s stability relies on the trustworthiness and transparency of its reserve holdings. Any breach of trust or mismanagement of reserves could affect its value.

- Market Risks: Tether’s price can be influenced by market forces and demand. While designed to stay close to $1, slight deviations can occur.

Understanding and mitigating these risks is crucial when considering your investment in Tether.

Is Tether a Good Investment?

The suitability of Tether as an investment depends on individual circumstances and investment goals. Tether’s stability and liquidity make it appealing for traders seeking a stablecoin for trading purposes. However, as Tether’s value is tied to the reserves backing it, it may not offer the same potential for price appreciation as other cryptocurrencies. Investors should carefully assess their risk tolerance and investment objectives before considering Tether as a long-term investment.

Tether Price Prediction

Predicting the future price of any cryptocurrency, including Tether, is challenging due to the volatility of the market. Tether’s peg to the US dollar aims to maintain a stable value, with minor fluctuations. However, external factors such as market conditions and regulatory changes can impact Tether’s price. It’s advisable to conduct thorough research and consult with financial experts to make informed decisions regarding Tether’s price potential.

Predicting the future price of any cryptocurrency, including Tether, is challenging due to the volatility of the market. Tether’s peg to the US dollar aims to maintain a stable value, with minor fluctuations. However, external factors such as market conditions and regulatory changes can impact Tether’s price. It’s advisable to conduct thorough research and consult with financial experts to make informed decisions regarding Tether’s price potential.

Tether Pros and Cons

When considering trading with Tether, it’s essential to weigh the pros and cons:

Pros of Trading with Tether:

- Stability: Tether’s stable value offers a reliable medium of exchange and a store of value.

- Liquidity: Tether is widely accepted and easily tradable on various cryptocurrency exchanges.

- Convenience: Tether provides a bridge between traditional fiat currencies and digital assets, facilitating seamless transactions.

- Reduced Volatility: Tether’s peg to the US dollar helps mitigate the risks associated with price fluctuations in other cryptocurrencies.

Cons of Trading with Tether

- Regulatory Risks: Tether operates within a regulatory framework that may evolve, potentially impacting its stability and usability.

- Counterparty Risks: Tether’s reliance on reserves and transparency of its holdings can be a source of concern if trust is compromised.

- Limited Potential for Price Appreciation: As a stablecoin, Tether’s primary objective is to maintain a stable value, limiting its potential for significant price growth.

Regulating Tether

Regulatory oversight of Tether and other stablecoins has been a topic of discussion within the cryptocurrency industry. Governments and regulatory bodies are exploring frameworks to ensure transparency, protect investors, and address potential risks associated with stablecoins. The regulatory landscape may evolve, and it’s important to stay updated on any changes that may affect the use and trading of Tether.

Regulatory oversight of Tether and other stablecoins has been a topic of discussion within the cryptocurrency industry. Governments and regulatory bodies are exploring frameworks to ensure transparency, protect investors, and address potential risks associated with stablecoins. The regulatory landscape may evolve, and it’s important to stay updated on any changes that may affect the use and trading of Tether.

Where to Buy Tether

When it comes to buying cryptocurrencies like Tether, having a reliable and user-friendly platform is crucial. Three popular platforms that offer a seamless trading experience are eToro, Binance, and Capital.com.

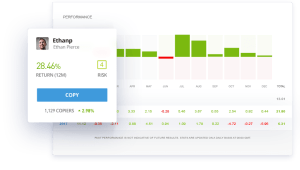

Buy Tether with Etoro – Overall Best Trading Platform with 0% Commission

Known for its social trading features, eToro has gained a strong reputation in the cryptocurrency community. It allows users to not only buy and sell cryptocurrencies but also to connect and interact with a community of traders. eToro offers a user-friendly interface, making it suitable for both beginners and experienced traders. Additionally, it provides a wide range of trading tools and features to assist users in making informed investment decisions.

Etoro Fees Table

Here’s an overview of the fees associated with buying Tether on Etoro:

| Fee Type | Amount |

| Trading Fee | Varies based on market |

| Deposit Fee | Free |

| Withdrawal Fee | $5 |

Pros and Cons of Using Etoro to Buy Tether:

Pros:

- User-friendly interface and intuitive platform

- Strong regulatory compliance

- Social trading features and copy trading options

Cons:

- Limited cryptocurrency selection compared to dedicated exchanges

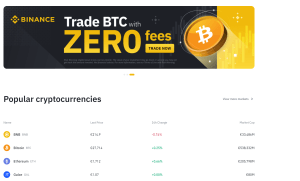

Buy Tether with Binance – The best Crypto trading platform

Binance is one of the largest and most well-known cryptocurrency exchanges globally. It offers a comprehensive trading platform that caters to both beginners and advanced traders. Binance provides a vast selection of cryptocurrencies, including Tether, and offers advanced trading features such as spot trading, futures trading, and margin trading. With its strong security measures and liquidity, Binance has become a go-to platform for many cryptocurrency enthusiasts.

Binance Fees Table

Here’s an overview of the fees associated with buying Tether on Binance:

| Fee Type | Amount |

| Trading Fee | 0.1% |

| Deposit Fee | Free |

| Withdrawal Fee | 1 USDT |

Pros and Cons of Using Binance to Buy Tether

Pros:

- Extensive selection of cryptocurrencies

- Advanced trading features and tools

- High liquidity and trading volumes

Cons:

- Requires familiarity with trading interfaces and concepts

Buy Tether with Capital.com – Popular Stock CFD with Great Trading Tools

Capital.com is a platform that aims to simplify the trading process for users. It provides a user-friendly interface and intuitive trading tools, making it suitable for beginners. Capital.com offers a wide range of trading options, including cryptocurrencies like Tether. It also provides access to a variety of educational resources and market analysis to help users make informed trading decisions. With its focus on user experience and educational support, Capital.com is an attractive option for those new to the world of cryptocurrency trading.

Capital.com Fees Table

Here’s an overview of the fees associated with buying Tether on Capital.com:

| Fee Type | Amount |

| Trading Fee | Spread-based |

| Deposit Fee | Free |

| Withdrawal Fee | Free |

Pros and Cons of Using Capital.com to Buy Tether

Pros:

- User-friendly interface and educational resources

- No trading commissions or deposit fees

- Accessible across various devices

Cons:

- Limited cryptocurrency selection compared to dedicated exchanges