Note: Before reading this article about buy Bitcoin!

We always strive to provide our customers with the latest news and information about finance, stocks and cryptocurrencies. However, we would like to point out that YOU SHOULD NOT take any content on our site as financial advice.

What is Bitcoin?

Bitcoin, often referred to as digital gold, is a decentralized digital currency that operates on a peer-to-peer network. It was invented in 2008 by an anonymous person or group of people using the pseudonym Satoshi Nakamoto. Bitcoin revolutionized the financial landscape by introducing a decentralized system that eliminates the need for intermediaries like banks.

Bitcoin, often referred to as digital gold, is a decentralized digital currency that operates on a peer-to-peer network. It was invented in 2008 by an anonymous person or group of people using the pseudonym Satoshi Nakamoto. Bitcoin revolutionized the financial landscape by introducing a decentralized system that eliminates the need for intermediaries like banks.

Bitcoin History

Bitcoin’s history dates back to its creation in 2009 when it was introduced to the world through an open-source software. Over the years, Bitcoin has experienced significant growth and volatility, attracting attention from investors and the mainstream media.

Price History

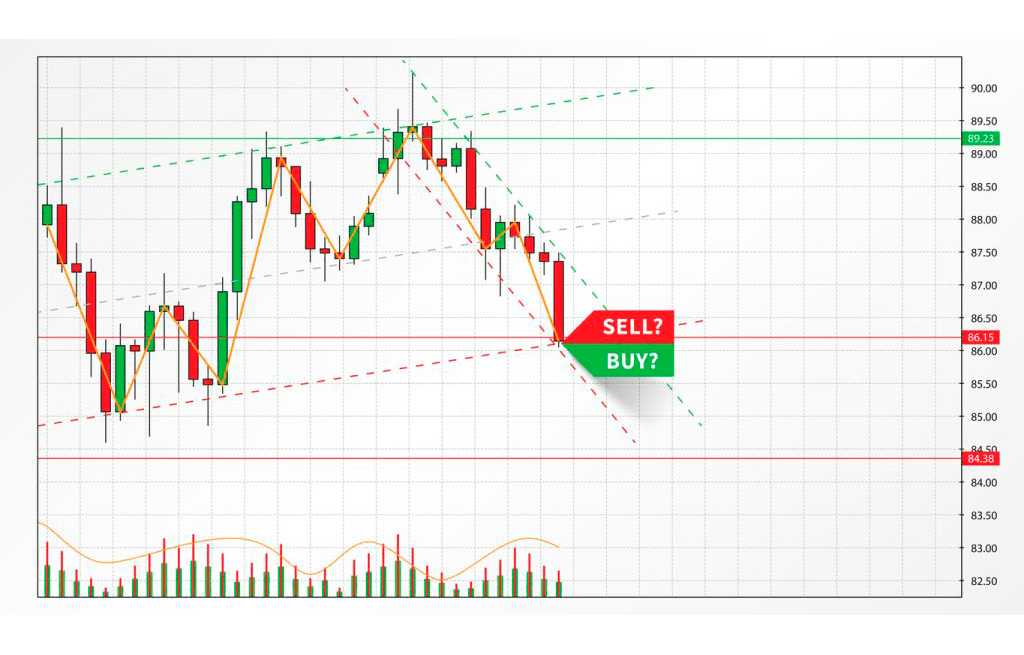

Bitcoin’s price history is a captivating rollercoaster ride that has captured the attention of investors and enthusiasts alike. Understanding Bitcoin’s price movements can provide valuable insights into its potential as an investment and its overall market dynamics.

Bitcoin’s journey began in 2009 when it was virtually worthless. In its early years, Bitcoin attracted a niche community of enthusiasts and early adopters who saw its potential as a decentralized currency. The price during this period remained relatively low, with occasional spikes and dips.

The real turning point for Bitcoin came in 2017 when the price skyrocketed to unprecedented levels. Bitcoin reached its all-time high in December 2017, surging above $20,000 per coin. This dramatic increase in price brought Bitcoin into the mainstream spotlight, attracting media attention and sparking widespread interest in cryptocurrencies.

However, the surge in price was followed by a significant correction, and Bitcoin experienced a prolonged bear market throughout 2018. The price dropped to around $3,000, causing many skeptics to question Bitcoin’s long-term viability.

Since then, Bitcoin has displayed a pattern of boom and bust cycles. It has seen periods of rapid growth, followed by significant price corrections. These fluctuations have been influenced by various factors, including market sentiment, regulatory developments, macroeconomic conditions, and technological advancements.

The year 2020 marked a significant milestone for Bitcoin as it experienced a remarkable recovery from the previous bear market. The price surged once again, surpassing its previous all-time high and reaching new peaks. This time, the surge was driven by growing institutional adoption, increased mainstream awareness, and the perception of Bitcoin as a potential hedge against inflation.

As of 2026, Bitcoin’s price continues to experience volatility, albeit with a higher overall price range compared to its early years. It’s important to note that while Bitcoin has witnessed substantial price increases, it has also experienced significant pullbacks and periods of consolidation.

How Does Bitcoin Work?

Bitcoin operates on a technology called blockchain, which is a decentralized and transparent ledger that records all Bitcoin transactions. This blockchain technology ensures security, immutability, and prevents double-spending. Bitcoin works through a process called mining, where powerful computers solve complex mathematical problems to validate transactions and add them to the blockchain.

Now that we understand the basics of Bitcoin, let’s explore why buying Bitcoin can be a lucrative investment opportunity.

Bitcoin is considered a hedge against traditional fiat currencies. With its limited supply and decentralized nature, Bitcoin is immune to government monetary policies and inflation. Many investors view Bitcoin as a store of value and a potential safe haven asset during times of economic uncertainty.

Furthermore, Bitcoin has the potential for significant growth in the long term. As more institutions and individuals adopt Bitcoin and recognize its value, the demand and price may continue to rise. Bitcoin’s scarcity and the halving events that reduce the rate of new supply contribute to its potential for appreciation.

Buy Bitcoin Safely

When it comes to investing in Bitcoin, safety should be a top priority. Here are some essential tips to ensure you buy Bitcoin safely:

Research and Education: Take the time to educate yourself about Bitcoin, its technology, and the risks associated with investing in cryptocurrencies.

Choose Reliable Exchanges: Select reputable and regulated cryptocurrency exchanges with a track record of security and reliability.

Two-Factor Authentication: Enable two-factor authentication (2FA) on your exchange accounts to add an extra layer of security.

Cold Storage: Consider storing your Bitcoin in a hardware wallet or a cold storage solution that keeps your funds offline, away from potential online threats.

Beware of Phishing: Be cautious of phishing attempts and always double-check the URL and security certificates of websites before entering your personal information or making transactions.

Risks of Buy Bitcoin

While Bitcoin offers exciting investment opportunities, it’s important to be aware of the risks involved. Here are some risks to consider:

- Price Volatility: Bitcoin’s price is highly volatile, and its value can fluctuate dramatically in short periods. This volatility can lead to substantial gains or losses.

- Regulatory Uncertainty: Governments around the world are still formulating regulations for cryptocurrencies. Changes in regulations may impact the value and use of Bitcoin.

- Cybersecurity Threats: The digital nature of Bitcoin makes it susceptible to hacking, phishing attacks, and other cybersecurity threats. It’s crucial to take appropriate security measures to protect your investment.

- Liquidity Risk: Cryptocurrency markets can experience liquidity issues, especially during times of extreme market volatility. This may affect your ability to buy or sell Bitcoin at desired prices.

Is Bitcoin a Good Investment?

The question of whether Bitcoin is a good investment depends on various factors, including your risk tolerance, investment goals, and understanding of the cryptocurrency market. Bitcoin has the potential for substantial returns, but it also carries risks. It’s essential to do thorough research and consult with a financial advisor before making any investment decisions.

Bitcoin Price Prediction

Predicting the future price of Bitcoin is challenging due to its volatile nature and numerous factors that can influence its value. While some experts believe Bitcoin has the potential to reach new all-time highs, others caution against excessive optimism. It’s crucial to approach price predictions with caution and make investment decisions based on thorough analysis rather than speculation.

Bitcoin Pros and Cons

Before diving into Bitcoin investment, let’s summarize some of the pros and cons:

Pros of Trading with Bitcoin:

- Potential for significant returns

- Hedge against inflation and traditional financial systems

- Increasing adoption by institutions and individuals

- Decentralized and transparent nature

- Ability to send and receive funds globally with low transaction fees

Cons of Trading with Bitcoin:

- High price volatility

- Regulatory uncertainties

- Security risks associated with digital assets

- Potential liquidity issues during market turbulence

Regulating Bitcoin

The regulatory landscape for cryptocurrencies, including Bitcoin, continues to evolve. Governments worldwide are grappling with how to regulate this new form of digital currency. While some countries embrace cryptocurrencies and blockchain technology, others impose stricter regulations. The regulatory environment can influence the acceptance and adoption of Bitcoin in different jurisdictions.

The regulatory landscape for cryptocurrencies, including Bitcoin, continues to evolve. Governments worldwide are grappling with how to regulate this new form of digital currency. While some countries embrace cryptocurrencies and blockchain technology, others impose stricter regulations. The regulatory environment can influence the acceptance and adoption of Bitcoin in different jurisdictions.

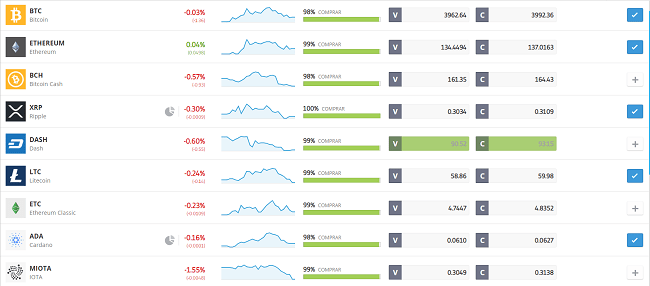

Where to Buy Bitcoin

When it comes to buying Bitcoin, there are several reputable platforms available. Let’s explore three popular options:

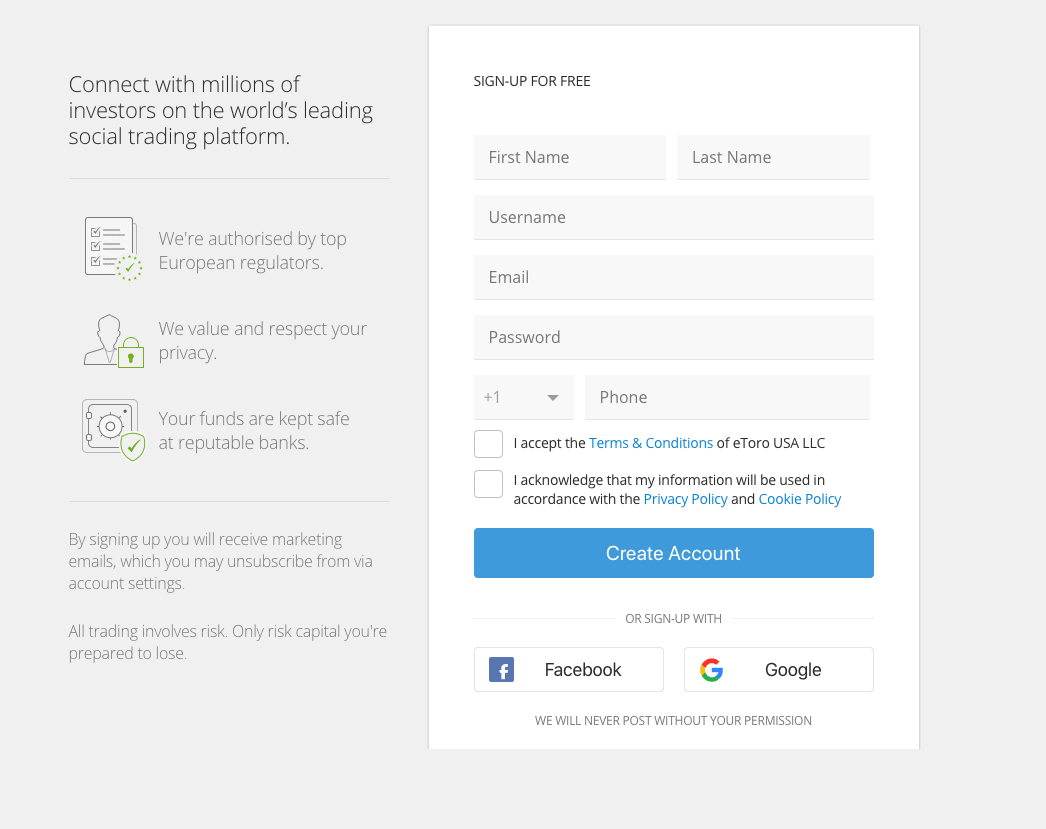

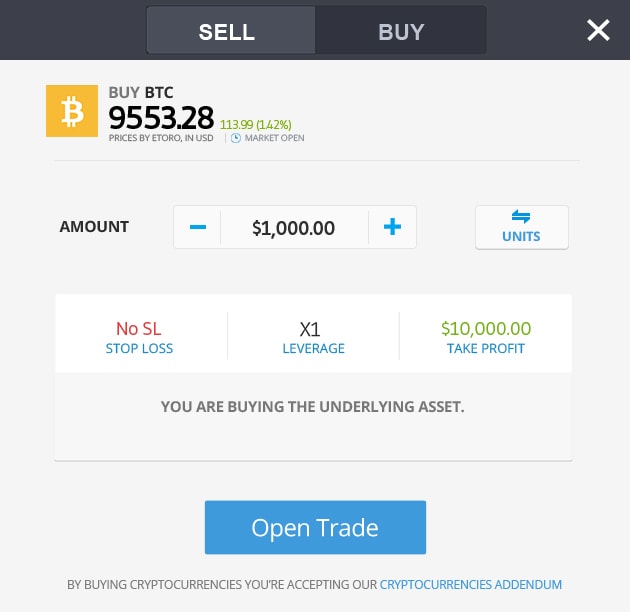

Buy Bitcoin with Etoro – Overall Best Trading Platform with 0% Commission

Etoro is a leading social trading platform that has gained popularity for its user-friendly interface and innovative features. With Etoro, users can not only buy and sell a wide range of assets, including cryptocurrencies like Bitcoin, but they can also engage in social trading. This unique feature allows users to interact, learn from, and even copy the trades of successful traders on the platform. Etoro provides a seamless and intuitive experience, making it an attractive choice for both beginners and experienced traders.

Etoro Fees Table:

|

Transaction Type |

Fee |

|

Buy Bitcoin |

0% |

|

Sell Bitcoin |

0% |

|

Deposit |

$0 |

|

Withdrawal |

$5 |

Pros and Cons of Using Etoro to Buy Bitcoin:

Pros:

- User-friendly platform for beginners

- Zero commission fees on buying and selling Bitcoin

- Social trading features and copy trading options

- Extensive educational resources

Cons:

- Limited cryptocurrency selection compared to other exchanges

- Withdrawal fees for transferring Bitcoin to external wallets

Buy Bitcoin with Binance – The best Crypto trading platform

Binance is one of the largest and most well-known cryptocurrency exchanges globally. It offers a vast selection of cryptocurrencies, including Bitcoin, and provides advanced trading features for experienced traders. Binance is known for its robust security measures, high liquidity, and competitive trading fees. The exchange also offers various trading options, such as spot trading, futures trading, and margin trading, catering to different trading preferences.

Binance Fees Table:

|

Transaction Type |

Fee |

|

Buy Bitcoin |

0.1% |

|

Sell Bitcoin |

0.1% |

|

Deposit |

Free |

|

Withdrawal |

Varies |

Pros and Cons of Using Binance to Buy Bitcoin:

Pros:

- Wide selection of cryptocurrencies available

- Advanced trading features and tools

- High liquidity for quick buying and selling

- Competitive fees for trading

Cons:

- Not as beginner-friendly as some other platforms

- Limited fiat currency support for direct deposits

- Complex interface may be overwhelming for newcomers

Buy Bitcoin with Capital.com – Popular Stock CFD with Great Trading Tools

Capital.com is a trusted online broker that offers a diverse range of financial instruments, including cryptocurrencies like Bitcoin. The platform stands out for its user-friendly interface, educational resources, and powerful trading tools. Capital.com aims to provide a seamless and intuitive trading experience, making it accessible to both beginners and seasoned traders. The platform also offers features such as price alerts, real-time market analysis, and a customizable trading interface to enhance the trading experience for its users.

Capital.com Fees Table:

|

Transaction Type |

Fee |

|

Buy Bitcoin |

0% |

|

Sell Bitcoin |

0% |

|

Deposit |

Free |

|

Withdrawal |

Free |

Pros and Cons of Using Capital.com to Buy Bitcoin:

Pros:

- Commission-free trading on Bitcoin

- Intuitive and user-friendly platform

- Educational resources and market analysis tools

- Free deposits and withdrawals

Cons:

- Limited cryptocurrency selection compared to dedicated exchanges

- No option to transfer Bitcoin to external wallets