Note: Before reading this article about Best Crypto Trading Platforms!

We always strive to provide our customers with the latest news and information about finance, stocks and cryptocurrencies. However, we would like to point out that YOU SHOULD NOT take any content on our site as financial advice.

Best Crypto Trading Platforms 2026 Reviewed

To kickstart your crypto trading journey in 2026, let’s explore the top crypto trading platforms that have garnered a strong reputation in the United States.

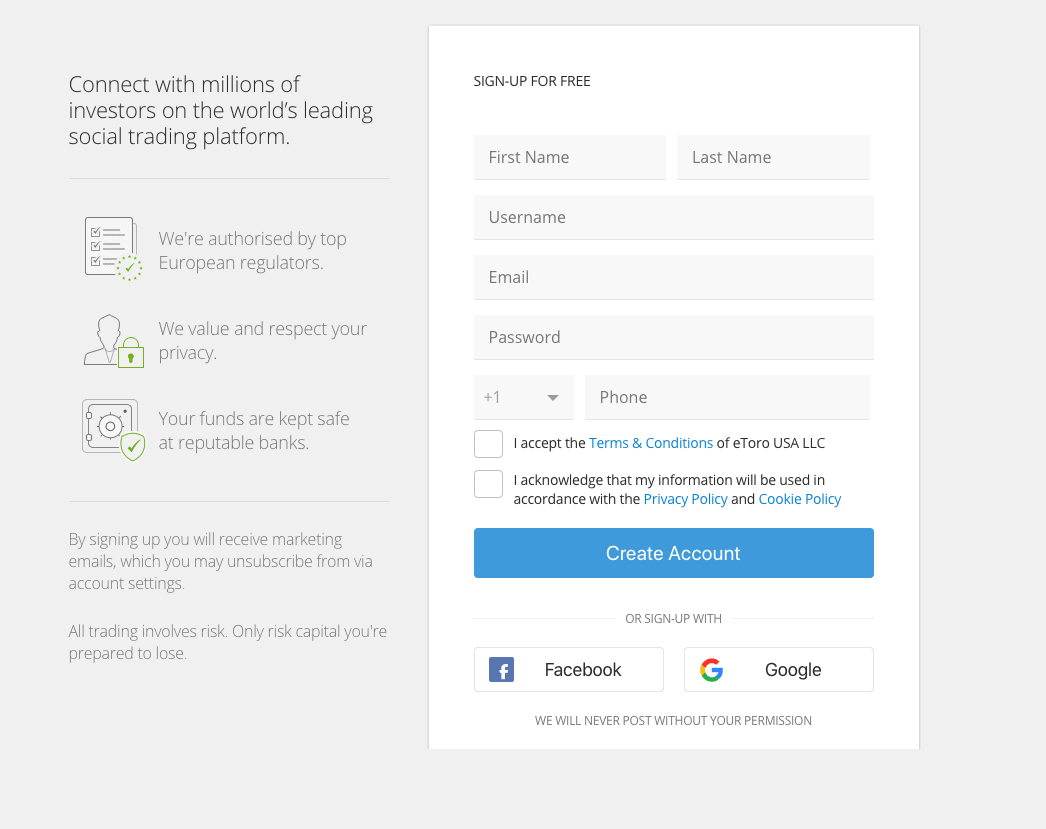

Etoro – One of the best Crypto Trading Platforms with 0% Commission

Etoro has established itself as one of the leading cryptocurrency trading platforms, known for its innovative approach that combines social trading with traditional investment opportunities. With a user-friendly interface and a wide range of supported cryptocurrencies, Etoro appeals to both novice and experienced traders alike.

The platform’s unique social trading feature allows users to connect with other traders, follow their investment strategies, and even copy their trades automatically. This social aspect creates a collaborative environment where traders can learn from each other, exchange ideas, and gain valuable insights.

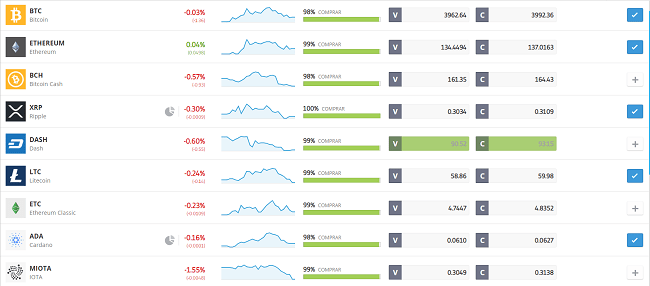

Etoro offers a diverse selection of cryptocurrencies, including popular options like Bitcoin, Ethereum, and Litecoin, as well as lesser-known altcoins. This broad range of assets gives traders the flexibility to diversify their portfolios and explore various investment opportunities within the crypto market.

Pros and Cons of Etoro

Pros:

- Social Trading Community: Etoro’s social trading feature enables users to interact with a vibrant community of traders, opening up opportunities for knowledge sharing, idea generation, and collaborative learning.

- User-Friendly Interface: Etoro’s platform is designed with simplicity in mind, making it accessible to traders of all experience levels. The intuitive interface, coupled with helpful educational resources, empowers beginners to navigate the platform with ease.

- Diverse Cryptocurrency Selection: Etoro offers a wide range of cryptocurrencies, allowing traders to explore various coins and tokens beyond the mainstream options. This diversity provides ample choices for investors seeking to diversify their crypto holdings.

- Regulation and Security: Etoro operates in compliance with regulatory standards, ensuring a secure trading environment for users. The platform employs advanced security measures to protect user funds and personal information.

Cons:

- Limited Availability: While Etoro is accessible in many countries worldwide, it may not be available in certain regions due to regulatory restrictions. Traders should check the platform’s availability in their specific location before signing up.

- Withdrawal Fees: Etoro charges withdrawal fees, which can vary depending on the chosen payment method and the user’s location. It’s important for traders to be aware of these fees and factor them into their overall trading costs.

Binance – The best Crypto trading platform

Binance has emerged as one of the most prominent cryptocurrency exchanges globally, renowned for its extensive selection of tradable assets and advanced trading features. Founded in 2017, Binance quickly gained popularity among crypto enthusiasts due to its robust platform and commitment to providing a seamless trading experience.

With Binance, traders have access to a vast array of cryptocurrencies, ranging from well-established coins like Bitcoin and Ethereum to newer altcoins. The platform actively seeks out promising projects and lists them for trading, giving users opportunities to invest in emerging digital assets.

Binance offers a range of trading options to cater to diverse trading preferences. In addition to spot trading, the platform supports margin trading, futures trading, and other advanced trading features. This comprehensive suite of tools empowers experienced traders to employ sophisticated strategies and capitalize on market opportunities.

Pros and Cons of Binance

Pros:

- Wide Range of Cryptocurrencies: Binance boasts an extensive selection of cryptocurrencies, including both major coins and lesser-known altcoins. This diverse offering ensures that traders can find opportunities across various markets.

- Advanced Trading Features: Binance provides advanced trading features, such as margin trading and futures trading, allowing experienced traders to maximize their potential profits and explore more complex trading strategies.

- Strong Liquidity: Binance’s large user base and high trading volumes contribute to robust liquidity, ensuring that traders can execute their orders quickly and efficiently.

- Global Presence: Binance has a global reach, making it accessible to traders from different parts of the world. The platform supports multiple languages, further enhancing its inclusivity.

Cons:

- Complex Interface: Binance’s platform may initially appear overwhelming to newcomers due to its extensive features and trading options. Traders new to cryptocurrency may require some time to familiarize themselves with the interface and tools.

- Limited Fiat Currency Support: While Binance supports various cryptocurrencies, its options for direct fiat currency deposits and withdrawals may be limited. Traders who prefer to use traditional fiat currencies should check the availability of their desired currency before opening an account.

Capital.com – Popular Stock CFD with Great Trading Tools

Capital.com is a reputable online trading platform that caters to a wide range of financial instruments, including cryptocurrencies. With a focus on simplicity, innovation, and user experience, Capital.com aims to provide traders with a seamless and intuitive trading environment.

The platform’s user-friendly interface makes it accessible to both novice and experienced traders. Capital.com offers a clean and intuitive layout, allowing users to navigate the platform effortlessly. The sleek design and intuitive features contribute to an overall pleasant trading experience.

Capital.com understands the importance of education and research for successful trading. The platform provides an extensive range of educational resources, including tutorials, articles, and video materials, to empower traders with knowledge. Additionally, the platform offers advanced charting tools and real-time market analysis to support traders in making informed decisions.

Pros and Cons of Capital.com

Pros:

- Educational Resources:com offers a wealth of educational materials, helping traders enhance their knowledge and understanding of the financial markets. The platform provides access to educational articles, tutorials, webinars, and a dedicated learning center.

- Competitive Spreads:com offers competitive spreads, providing traders with cost-effective trading opportunities. Tight spreads ensure that traders can enter and exit positions with minimal costs.

- AI-Powered Technology:com utilizes artificial intelligence (AI) algorithms to provide personalized insights and real-time notifications to traders. The platform analyzes market data and user behavior to offer tailored recommendations and alerts, empowering traders to make well-informed decisions.

- Regulated and Secure:com operates under the oversight of reputable regulatory authorities, ensuring adherence to stringent security measures and investor protection standards. Traders can have confidence in the platform’s commitment to maintaining a safe trading environment.

Cons:

- Limited Cryptocurrency Selection: While Capital.com offers a range of cryptocurrencies for trading, its selection may be more limited compared to dedicated cryptocurrency exchanges. Traders seeking access to a wide range of altcoins may find other platforms more suitable for their needs.

- No Direct Cryptocurrency Deposits or Withdrawals:com does not support direct deposits or withdrawals of cryptocurrencies. Traders must convert their cryptocurrencies into fiat currencies or use other platforms to transfer their digital assets.

How to Choose theRegulated and Best Crypto Trading Platforms in the United States

When selecting the Best Crypto Trading Platforms, it’s essential to consider several factors to ensure a secure and rewarding trading experience. Here are key aspects to evaluate:

Assets

Evaluate the range of cryptocurrencies available on the platform. Look for platforms that offer a diverse selection, allowing you to explore different investment opportunities. Consider not only the major cryptocurrencies but also the availability of lesser-known altcoins.

Fees

Consider the fee structure of the platform, including trading fees, deposit fees, and withdrawal fees. Compare fee structures across different platforms to find the most cost-effective option for your trading needs. Pay attention to factors such as maker and taker fees, as they can impact your overall profitability.

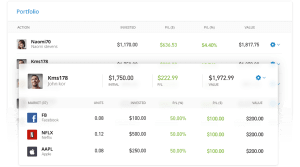

Copy Trading

If you’re new to trading or prefer a more passive approach, consider platforms that offer copy trading functionality. This feature allows you to automatically replicate the trades of successful traders, leveraging their expertise to potentially boost your own trading results.

Regulation and Safety

Ensure that the platform you choose operates under the supervision of reputable regulatory bodies. Regulatory oversight adds an extra layer of security and ensures that the platform follows strict compliance standards. Look for platforms that prioritize user security through measures such as two-factor authentication and cold storage for funds.

Ensure that the platform you choose operates under the supervision of reputable regulatory bodies. Regulatory oversight adds an extra layer of security and ensures that the platform follows strict compliance standards. Look for platforms that prioritize user security through measures such as two-factor authentication and cold storage for funds.

Deposit and Withdrawal Fees

Check the deposit and withdrawal options available on the platform. Consider the fees associated with these transactions and ensure they align with your budget and preferences.

Additionally, evaluate the processing times for deposits and withdrawals to ensure they meet your expectations.

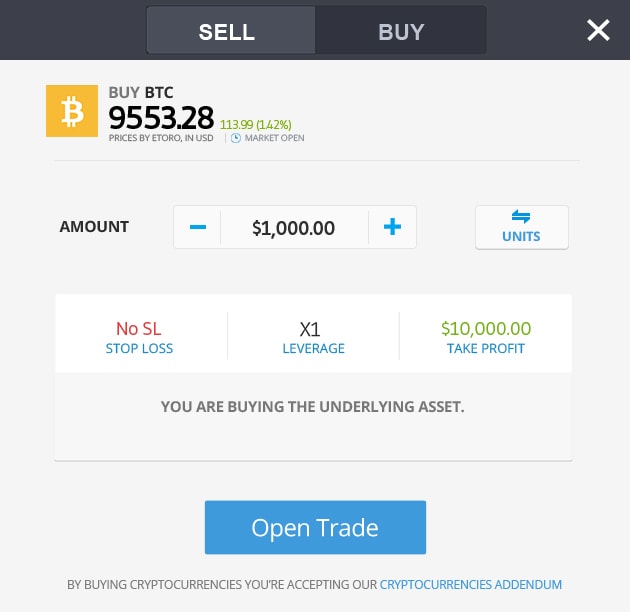

Trading Tools & Features

Evaluate the trading tools and features provided by the platform. Look for features such as real-time market data, advanced charting tools, order types, and risk management features. These tools can enhance your trading experience and provide valuable insights for making informed decisions.

Education, Research & Analysis

Consider the availability of educational resources, research materials, and analysis tools provided by the platform. Look for platforms that offer educational articles, webinars, tutorials, and market analysis to support your trading journey. Access to quality educational materials can help you stay informed and make better trading decisions.

User Experience

A smooth and intuitive user experience is crucial for an enjoyable trading journey. Look for platforms with user-friendly interfaces, responsive customer support, and easy navigation.

A well-designed platform enhances efficiency and allows you to focus on your trades without unnecessary distractions.

Commission Fees

Compare the commission fees charged by different platforms. Lower commission fees can significantly impact your overall profitability, especially for frequent traders. Consider platforms that offer competitive and transparent fee structures.

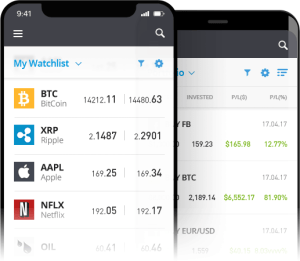

Mobile App

If you prefer trading on the go, check if the platform offers a reliable and feature-rich mobile app. A well-designed mobile app allows you to monitor the markets, execute trades, and access essential account features conveniently from your mobile device.

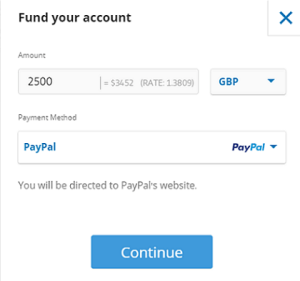

Payment Methods

Evaluate the payment methods supported by the platform. Look for platforms that offer a variety of deposit and withdrawal options, including bank transfers, credit cards, and digital wallets. Having flexible payment methods can make it easier to fund your trading account and access your funds when needed.

Customer Service

Reliable and responsive customer service is crucial when using a trading platform. Look for platforms that provide multiple channels of customer support, such as live chat, email, and phone support. Prompt assistance and effective communication can help address any issues or inquiries that arise during your trading journey.

Reliable and responsive customer service is crucial when using a trading platform. Look for platforms that provide multiple channels of customer support, such as live chat, email, and phone support. Prompt assistance and effective communication can help address any issues or inquiries that arise during your trading journey.

Risk Management Strategies for Crypto Trading

Risk management is a crucial aspect of successful crypto trading, and it’s essential for traders to implement effective strategies to mitigate potential losses. When engaging in cryptocurrency trading on the best crypto trading platforms, it’s important to establish risk management techniques that align with your trading goals and risk tolerance. This includes setting stop-loss orders to limit potential losses, diversifying your portfolio to spread risk across different assets, and carefully managing leverage to avoid excessive exposure. Additionally, staying informed about market trends, conducting thorough research, and practicing disciplined trading habits are key components of an effective risk management strategy. By incorporating these risk management practices into your crypto trading activities on the best crypto trading platforms, you can enhance your chances of long-term success and navigate the volatile crypto market with confidence.

Best Crypto Trading 2026

When it comes to trading cryptocurrencies on the best crypto trading platforms, there are several top options worth considering. These cryptocurrencies have established themselves as prominent players in the market, each with its unique features and potential for profitability. Here are some of the best cryptos for trading:

- Bitcoin (BTC): As the pioneer and most widely recognized cryptocurrency, Bitcoin remains a popular choice among traders, offering high liquidity and market dominance.

- Ethereum (ETH): Known for its smart contract capabilities, Ethereum has gained significant traction and serves as a platform for decentralized applications (DApps) and the creation of new tokens.

- Ripple (XRP): Ripple offers fast and low-cost international money transfers, making it a popular choice for cross-border transactions and remittances.

- Litecoin (LTC): Created as a “lite” version of Bitcoin, Litecoin offers faster block generation times and a different hashing algorithm, making it attractive for both traders and everyday transactions.

- Cardano (ADA): Cardano aims to provide a secure and scalable blockchain platform, utilizing a research-driven approach to enhance the security and sustainability of decentralized applications.

These cryptocurrencies, available on the best crypto trading platforms, present opportunities for traders to participate in the dynamic and ever-evolving cryptocurrency market. By conducting thorough research, understanding the unique features of each cryptocurrency, and utilizing the trading tools and features provided by these platforms, traders can make informed decisions and potentially capitalize on market movements.