Note: Before reading this article about Buy Dogecoin!

We always strive to provide our customers with the latest news and information about finance, stocks and cryptocurrencies. However, we would like to point out that YOU SHOULD NOT take any content on our site as financial advice.

What is Dogecoin?

Dogecoin History

Dogecoin was created in 2013 as a fun and lighthearted cryptocurrency. It originated from an internet meme featuring a Shiba Inu dog, which quickly gained popularity. However, what started as a joke currency soon garnered a dedicated following and became a significant player in the crypto market [1].

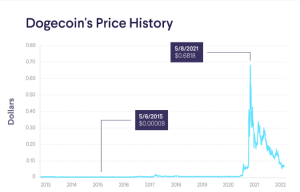

Price History

Dogecoin’s price history has been marked by notable fluctuations. It experienced a surge in early 2021, largely driven by social media attention and endorsements from high-profile individuals. However, it’s important to note that cryptocurrency prices are highly volatile, and past performance is not indicative of future results.

How Does Dogecoin Work?

Dogecoin operates on a decentralized blockchain, similar to other cryptocurrencies. It utilizes a proof-of-work consensus mechanism, where miners validate transactions and secure the network. Dogecoin’s technology is based on Litecoin, with a few modifications to enhance transaction speed and supply inflation.

Why Buy Dogecoin?

Dogecoin has gained popularity for several reasons. Firstly, its strong community and active social media presence have contributed to its widespread recognition. Additionally, Dogecoin has been used for charitable causes, demonstrating its potential impact beyond the realm of finance. However, it’s important to assess your own investment goals and risk tolerance before buying Dogecoin.

How to Buy Dogecoin Safely

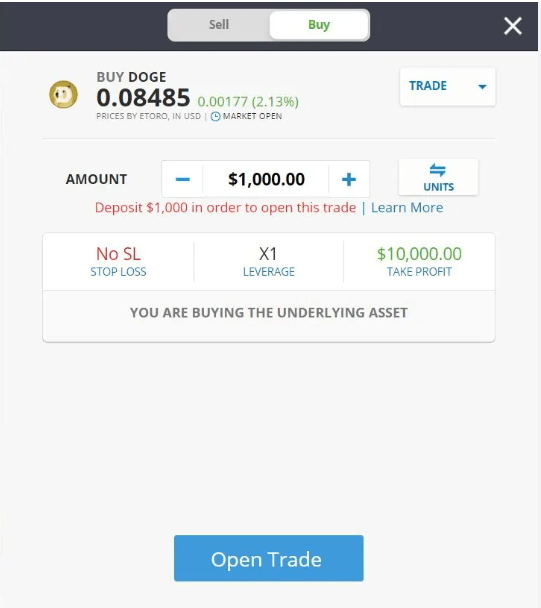

When buying Dogecoin, it’s crucial to prioritize safety and choose reputable platforms. One such platform is Etoro, a trusted and user-friendly social trading platform. Etoro offers a seamless and secure experience, allowing you to buy, sell, and trade Dogecoin with ease. By using a regulated platform, you can have peace of mind knowing that your investments are protected.

Risks of Buying Dogecoin

While Dogecoin has gained widespread attention and popularity, it’s essential to be aware of the potential risks associated with investing in this cryptocurrency. Here are some significant risks to consider before buying Dogecoin:

-

Volatility: Dogecoin, like many other cryptocurrencies, is known for its extreme price volatility. The value of Dogecoin can experience significant fluctuations in short periods, making it a high-risk investment.

-

Lack of Fundamental Value: Dogecoin was initially created as a meme cryptocurrency and lacks the same level of underlying fundamental value as other established cryptocurrencies. Its value primarily relies on market speculation and sentiment, which can lead to rapid price changes based on social media trends or online communities.

-

Market Manipulation: The cryptocurrency market is susceptible to manipulation due to its decentralized and unregulated nature. Dogecoin’s relatively low market cap makes it particularly vulnerable to pump-and-dump schemes or price manipulation by influential market participants.

-

Regulatory Uncertainty: The regulatory landscape surrounding cryptocurrencies is still evolving, and changes in regulations or government policies can significantly impact the value and legality of Dogecoin. Regulatory actions or crackdowns on cryptocurrencies could lead to increased scrutiny, restrictions, or even a loss of value for Dogecoin holders.

-

Dependency on Market Sentiment: Dogecoin’s value is heavily influenced by market sentiment, social media trends, and celebrity endorsements. Price movements driven by hype and speculative buying can lead to sudden and significant price drops when the sentiment changes.

It is crucial to thoroughly research and understand the risks associated with Dogecoin before making any investment decisions. Investing in cryptocurrencies carries inherent risks, and it’s essential to consider your risk tolerance, financial situation, and long-term investment goals. Consulting with a financial advisor or conducting extensive due diligence can help mitigate these risks and make informed investment choices.

Is Dogecoin a Good Investment?

Determining whether Dogecoin is a good investment depends on various factors, including your risk tolerance and investment strategy. Dogecoin’s volatility and speculative nature make it a high-risk investment. It’s crucial to conduct thorough research, assess market trends, and consider professional advice before making any investment decisions.

Dogecoin Price Prediction

Predicting the future price of cryptocurrencies is challenging, and Dogecoin is no exception. While some experts believe in its potential, others remain skeptical. It’s important to approach price predictions with caution and consider them as speculative opinions rather than concrete guarantees.

Dogecoin Pros and Cons

Pros of Trading with Dogecoin:

- Community and Popularity: Dogecoin boasts a strong and engaged community, which has contributed to its widespread recognition and acceptance.

- Ease of Use: Dogecoin is known for its user-friendly nature, making it accessible to both experienced traders and beginners.

- Charitable Impact: Dogecoin has been utilized for charitable causes, demonstrating its potential for positive social impact.

- Market Volatility: For traders who thrive in a volatile market, Dogecoin’s price fluctuations present potential opportunities for profit.

Cons of Trading with Dogecoin:

- High Volatility: Dogecoin’s price is highly volatile, which can result in significant gains or losses within a short period.

- Regulatory Uncertainty: The regulatory landscape surrounding cryptocurrencies is still evolving, introducing potential risks and uncertainties.

- Speculative Nature: Dogecoin’s value is largely driven by market sentiment and social media trends, making it susceptible to speculative behavior.

- Limited Use Cases: Compared to some other cryptocurrencies, Dogecoin has limited adoption in terms of real-world use cases.

Regulating Dogecoin

Regulation of cryptocurrencies like Dogecoin is a topic of ongoing discussion and development. Governments and regulatory bodies are increasingly focusing on the crypto industry to ensure investor protection, prevent fraudulent activities, and maintain market integrity. It’s important to stay informed about regulatory updates and comply with the relevant laws and regulations in your jurisdiction.

Regulation of cryptocurrencies like Dogecoin is a topic of ongoing discussion and development. Governments and regulatory bodies are increasingly focusing on the crypto industry to ensure investor protection, prevent fraudulent activities, and maintain market integrity. It’s important to stay informed about regulatory updates and comply with the relevant laws and regulations in your jurisdiction.

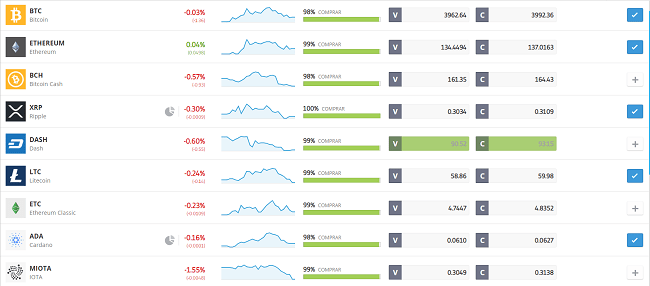

Where to Buy Dogecoin

When it comes to purchasing Dogecoin, individuals have the convenience of choosing from several platforms that offer accessible options. Let’s explore three renowned platforms that are highly regarded in the cryptocurrency community and are worth considering for buying Dogecoin:

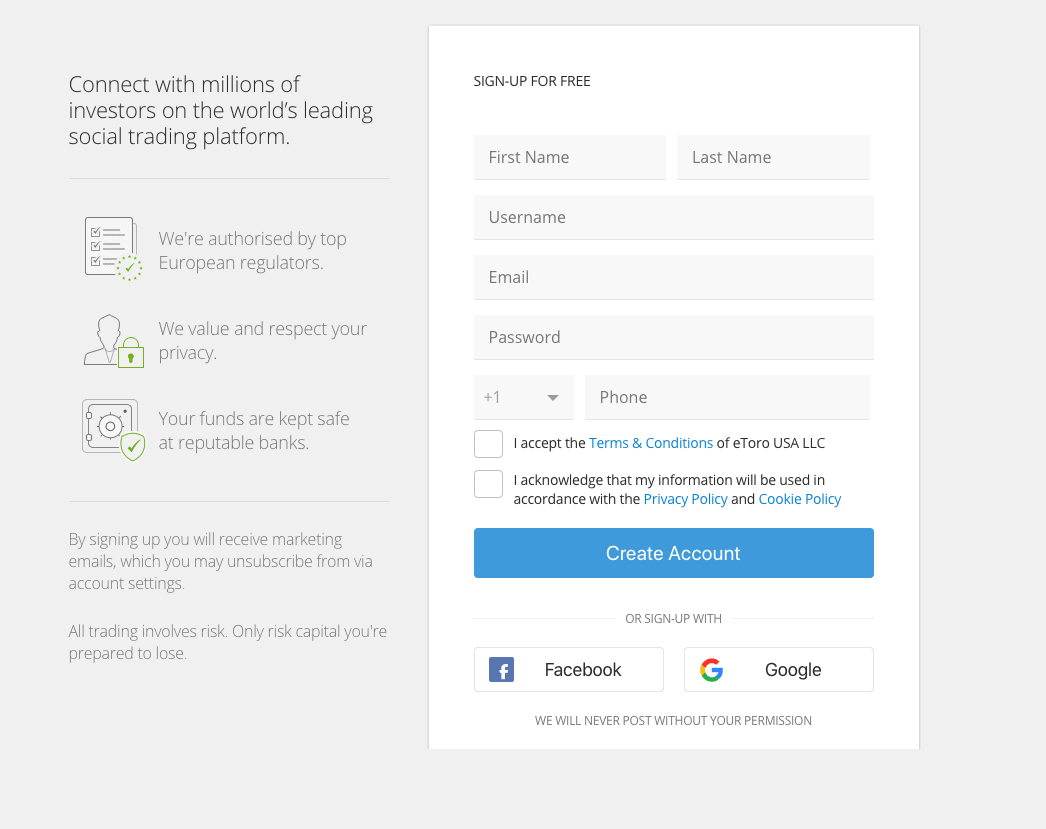

Etoro – Overall Best Trading Platform with 0% Commission

Etoro is a leading social trading platform that has gained popularity in the world of cryptocurrency investing. With a user-friendly interface and a wide range of financial instruments, including cryptocurrencies like Dogecoin, Etoro offers a seamless trading experience for both beginners and experienced traders. What sets Etoro apart is its unique social trading feature, allowing users to interact with other traders, learn from their strategies, and even automatically copy their trades. This makes it an excellent platform for those looking to explore the world of Dogecoin and engage in social trading.

Etoro Fees Table

When trading Dogecoin on Etoro, it’s essential to be aware of the associated fees. The table below provides an overview of the fees charged by Etoro:

| Fee Type | Description |

| Spreads | Etoro charges spreads on cryptocurrency trades, which may vary depending on market conditions. |

| Conversion Fees | If you’re trading Dogecoin against a different currency, conversion fees may apply. |

| Deposit Fees | Etoro does not charge deposit fees for cryptocurrency transactions. |

| Withdrawal Fees | Withdrawal fees may apply when transferring Dogecoin or other funds from Etoro to an external wallet or account. |

Note: The fees mentioned are subject to change. It’s advisable to refer to Etoro’s official website for the most up-to-date fee information.

Pros and Cons of Using Etoro to Buy Dogecoin

Pros:

- User-friendly interface and intuitive platform.

- Social trading features that allow users to interact and learn from other traders.

- Regulated and reputable platform, providing a secure trading environment.

- Wide range of financial instruments, including cryptocurrencies like Dogecoin.

Cons:

- Limited availability in some countries.

- Spreads and fees may be higher compared to other exchanges.

- Withdrawal process may have certain requirements and timeframes.

Binance – The best Crypto trading platform

Binance is one of the largest and most reputable cryptocurrency exchanges globally, known for its extensive selection of cryptocurrencies and advanced trading features. With a user-friendly interface and a range of trading options, Binance caters to both beginners and professional traders. The platform provides a secure environment for buying, selling, and trading cryptocurrencies, including Dogecoin. Binance also offers various trading tools and features, such as spot trading, futures trading, and staking, making it a comprehensive platform for cryptocurrency enthusiasts.

Binance Fees Table

When trading Dogecoin on Binance, it’s important to consider the associated fees. The table below outlines the main fee types charged by Binance:

| Fee Type | Description |

| Trading Fees | Binance charges a standard trading fee of 0.1% for spot trading. The fee may vary based on factors such as trading volume and membership level. |

| Deposit Fees | Binance does not charge deposit fees for cryptocurrencies. However, there may be fees for depositing fiat currencies. |

| Withdrawal Fees | Withdrawal fees vary depending on the specific cryptocurrency being withdrawn. The fees are dynamic and subject to change based on network congestion and market conditions. |

Note: The fees mentioned are subject to change. It’s advisable to refer to Binance’s official website for the most up-to-date fee information.

Pros and Cons of Using Binance to Buy Dogecoin

Pros:

- Wide range of cryptocurrencies available for trading, including Dogecoin.

- Advanced trading features and options, catering to different trading strategies.

- High liquidity, allowing for efficient buying and selling of assets.

- Competitive trading fees for spot trading.

Cons:

- The interface may be overwhelming for beginners.

- Withdrawal fees can vary and may be higher for certain cryptocurrencies.

- Limited support for fiat currency deposits in some regions.

Capital.com – Popular Stock CFD with Great Trading Tools

Capital.com is a popular online trading platform that offers a user-friendly interface and a wide range of financial instruments, including cryptocurrencies like Dogecoin. It aims to make trading accessible to all, with a focus on providing a seamless experience for beginners. Capital.com stands out for its educational resources, which empower users to enhance their trading knowledge and make informed investment decisions. With competitive spreads and a range of trading tools, Capital.com offers a suitable platform for those looking to buy Dogecoin and explore the world of cryptocurrency trading.

These platforms, Etoro, Binance, and Capital.com, have established themselves as reliable and reputable options for buying Dogecoin. Whether you’re a beginner or an experienced trader, each platform offers its unique features and advantages, providing you with the opportunity to participate in the exciting world of Dogecoin and cryptocurrency trading.

Capital.com Fees Table

When trading Dogecoin on Capital.com, it’s important to understand the associated fees. The table below provides an overview of the main fees charged by Capital.com:

| Fee Type | Description |

| Spreads | Capital.com charges spreads on cryptocurrency trades, which may vary depending on market conditions. |

| Overnight Fees | If you hold positions overnight, overnight fees, also known as swap fees, may apply. These fees are incurred for keeping positions open beyond a specified time. |

| Deposit Fees | Capital.com does not charge deposit fees for cryptocurrency transactions. |

| Withdrawal Fees | Withdrawal fees may apply when transferring funds from Capital.com to an external wallet or account. |

Note: The fees mentioned are subject to change. It’s advisable to refer to Capital.com’s official website for the most up-to-date fee information.

Pros and Cons of Using Capital.com to Buy Dogecoin

Pros:

- User-friendly and intuitive platform, suitable for beginners.

- Access to a wide range of financial instruments, including cryptocurrencies.

- Competitive spreads on cryptocurrency trades.

- Availability of educational resources and tools to enhance trading knowledge.

Cons:

- Limited range of cryptocurrencies compared to other exchanges.

- Overnight fees may be applicable for holding positions overnight.

- Withdrawal fees may be incurred when transferring funds.