Note: Before reading this article about buy Ethereum!

We always strive to provide our customers with the latest news and information about finance, stocks and cryptocurrencies. However, we would like to point out that YOU SHOULD NOT take any content on our site as financial advice.

What is Ethereum?

Ethereum is a decentralized blockchain platform that enables the creation and execution of smart contracts and decentralized applications (DApps). Launched in 2015 by Vitalik Buterin, Ethereum introduced the concept of a programmable blockchain, revolutionizing the possibilities of blockchain technology beyond digital currency transactions.

Ethereum History

Ethereum’s journey began with a whitepaper published by Vitalik Buterin in late 2013. The project gained significant attention and support from the cryptocurrency community, leading to its official launch in July 2015. Since then, Ethereum has evolved into the second-largest cryptocurrency by market capitalization, attracting developers, businesses, and investors worldwide.

Price History

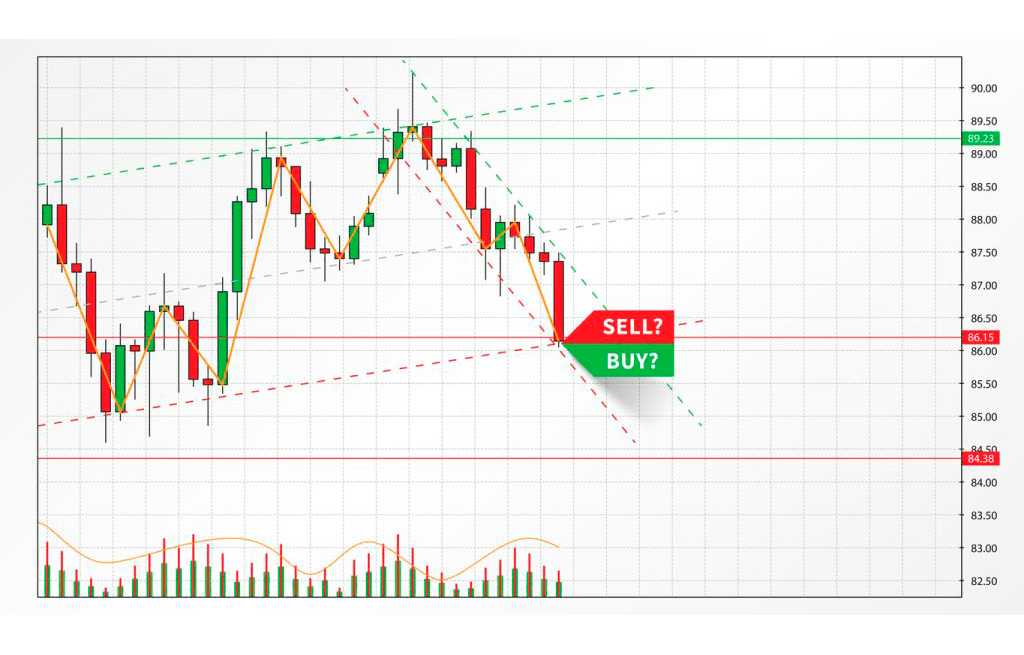

Ethereum’s price history has been characterized by volatility, growth, and occasional market corrections. In the early days, Ethereum had a humble value, but its price experienced a significant surge in 2017, reaching an all-time high. However, like many cryptocurrencies, Ethereum also faced a market downturn in the following year. Since then, Ethereum has shown resilience, with its price fluctuating in response to market demand, technological developments, and industry trends.

How Does Ethereum Work?

Ethereum operates on a decentralized network of computers known as nodes, which run the Ethereum Virtual Machine (EVM). The EVM executes smart contracts, which are self-executing agreements with predefined conditions. These contracts facilitate various functions, such as transferring digital assets, establishing governance mechanisms, and enabling decentralized applications.

Ethereum’s native cryptocurrency is called Ether (ETH), which serves as a medium of exchange for transactions and as a reward for miners who validate and secure the network. Ethereum’s unique feature is its ability to create and deploy smart contracts, offering developers a powerful platform to build decentralized applications across a wide range of industries.

Why Buy Ethereum?

Buying Ethereum presents several potential advantages for investors and enthusiasts alike. Here are some key reasons to consider investing in Ethereum:

- Innovative Technology: Ethereum’s platform allows developers to create decentralized applications and smart contracts, fostering innovation and disrupting traditional industries.

- Growing Adoption: Ethereum has gained significant adoption from individuals, businesses, and organizations seeking to leverage its capabilities for various purposes, including decentralized finance (DeFi) and non-fungible tokens (NFTs).

- Ecosystem Expansion: Ethereum’s ecosystem continues to grow, attracting developers, investors, and users who contribute to its development and expansion.

- Potential for Profit: Like other cryptocurrencies, Ethereum offers the potential for substantial returns on investment, given its historical price performance and its position as a leading digital asset.

It’s important to note that investing in Ethereum, like any investment, carries risks. It’s advisable to conduct thorough research, assess your risk tolerance, and consider consulting with a financial advisor before making any investment decisions.

How Can I Buy Ethereum Safely

When it comes to buying Ethereum, it’s crucial to prioritize safety and security. Here are some steps to follow for safe Ethereum purchases:

- Choose a Reputable Exchange: Select a reputable cryptocurrency exchange that supports Ethereum trading and has a track record of security and reliability.

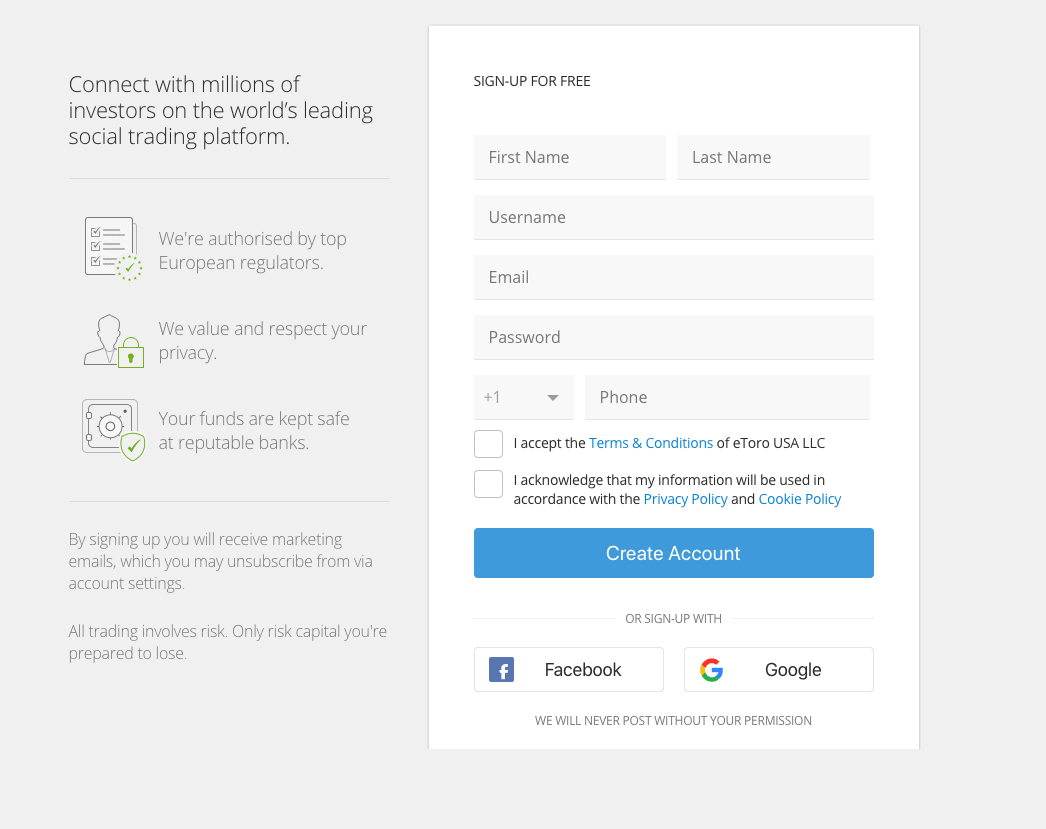

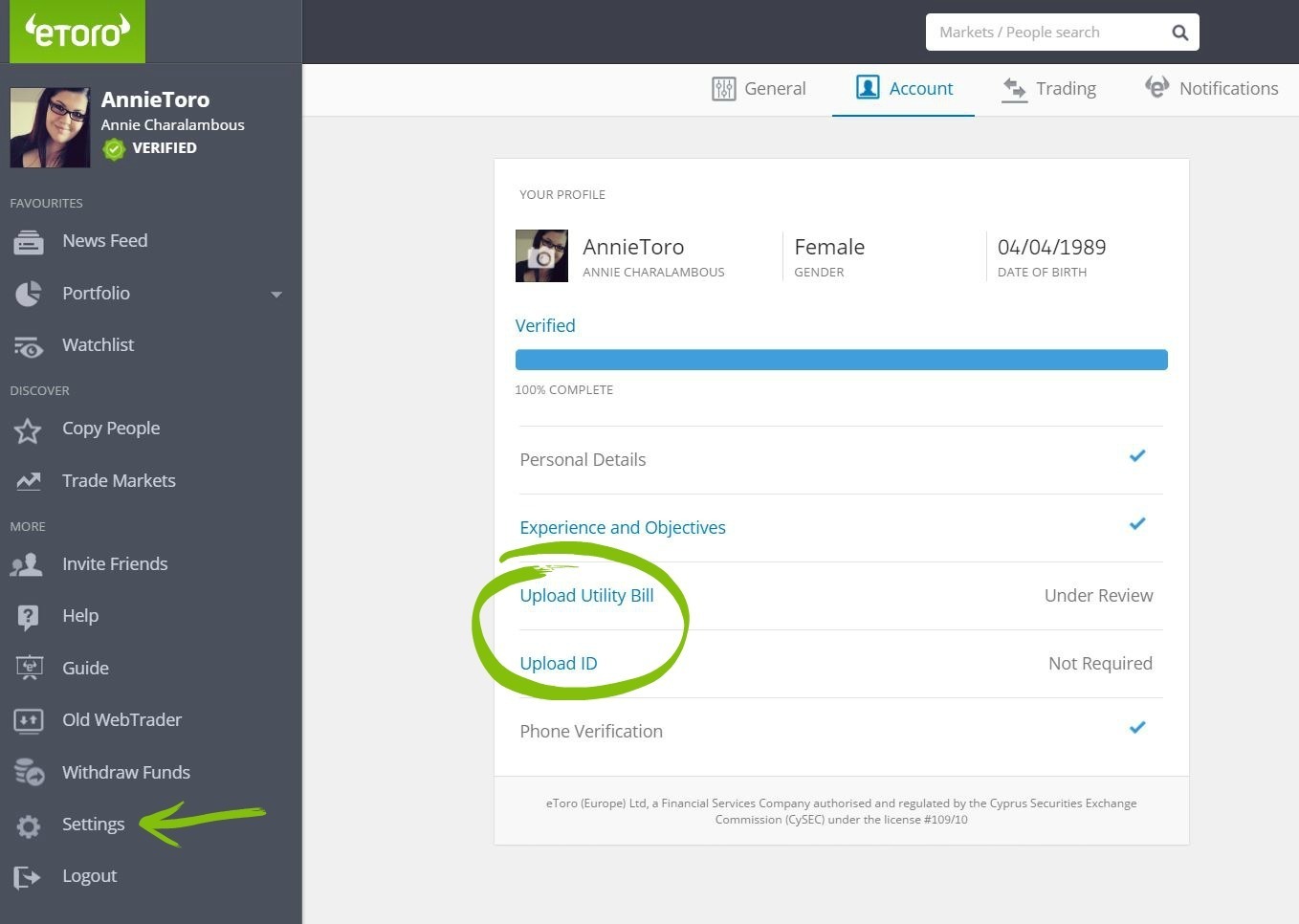

- Create an Account: Sign up for an account on the chosen exchange and complete the necessary verification process to comply with regulatory requirements.

- Secure Your Account: Enable two-factor authentication (2FA) and use a strong, unique password to protect your exchange account from unauthorized access.

- Set Up a Wallet: Consider setting up a digital wallet to store your Ethereum securely. Wallet options include hardware wallets, software wallets, and online wallets.

- Make the Purchase: Once your account is set up and your wallet is ready, you can proceed with the purchase of Ethereum. Here are a few popular platforms where you can buy Ethereum:

Risks of Buying Ethereum

While Ethereum presents exciting opportunities, it’s essential to be aware of the risks associated with buying and investing in cryptocurrencies. Here are some potential risks to consider:

- Volatility: Cryptocurrencies, including Ethereum, are known for their price volatility. Prices can fluctuate significantly within short periods, which may result in substantial gains or losses.

- Regulatory Uncertainty: The regulatory landscape surrounding cryptocurrencies is still evolving. Changes in regulations or government actions can impact the market and investor sentiment.

- Technological Risks: Ethereum, like any technology, is not immune to technical vulnerabilities, potential hacks, or software bugs that could compromise the security and stability of the network.

- Market Manipulation: Cryptocurrency markets can be susceptible to manipulation, including pump-and-dump schemes or price manipulation by large players in the market.

- Liquidity and Exchange Risks: Some smaller or less reputable exchanges may have lower liquidity, making it harder to buy or sell Ethereum. There is also a risk of exchange hacks or security breaches on certain platforms.

It’s important to conduct thorough research, stay informed about market trends, and carefully consider your risk tolerance before investing in Ethereum or any other cryptocurrency.

Is Ethereum a Good Investment?

The question of whether Ethereum is a good investment depends on various factors, including your individual financial goals, risk tolerance, and investment strategy. Here are a few points to consider when evaluating Ethereum as an investment:

- Market Potential: Ethereum’s growing adoption, innovative technology, and expanding ecosystem suggest it has the potential for future growth and utility.

- Diversification: Including Ethereum in a well-diversified investment portfolio can provide exposure to the cryptocurrency market and potentially mitigate risk through diversification.

- Long-Term Outlook: Some investors believe that Ethereum’s underlying technology and its role in the decentralized finance (DeFi) and non-fungible token (NFT) sectors may contribute to its long-term value.

However, it’s important to note that cryptocurrency investments come with inherent risks, and the market is known for its volatility. It’s crucial to assess your own financial situation, conduct thorough research, and seek professional advice before making any investment decisions.

Ethereum Price Prediction

Predicting the future price of Ethereum or any cryptocurrency is challenging due to the market’s complexity and volatility. Price predictions are speculative and should not be considered financial advice. However, industry experts and analysts often offer insights based on market trends and fundamental analysis.

The Ethereum community believes that ongoing technological advancements, increasing adoption, and the implementation of Ethereum 2.0, a major upgrade to the network, could positively impact the price. However, it’s important to remember that cryptocurrency markets are influenced by various factors, including market sentiment, regulatory changes, and global economic conditions.

It’s advisable to approach price predictions with caution, focusing on long-term trends and fundamental developments rather than short-term price fluctuations.

Ethereum Pros and Cons

Let’s summarize the pros and cons of trading with Ethereum:

Pros of Trading with Ethereum:

- Innovative Technology: Ethereum’s platform enables the development of decentralized applications and smart contracts, fostering innovation across industries.

- Growing Adoption: Ethereum has gained significant adoption, attracting developers, businesses, and users who contribute to its ecosystem’s expansion.

- Diverse Use Cases: Ethereum’s flexibility allows for various use cases, including decentralized finance (DeFi), non-fungible tokens (NFTs), and more.

- Potential for Profit: Ethereum’s historical price performance and its position as a leading cryptocurrency have the potential for attractive returns on investment.

Cons of Trading with Ethereum:

- Volatility: Ethereum, like other cryptocurrencies, is subject to price volatility, which can lead to significant gains or losses.

- Regulatory Uncertainty: The regulatory environment surrounding cryptocurrencies is still developing, and changes in regulations can impact the market.

- Technological Risks: Ethereum’s technology, while robust, is not without its vulnerabilities and risks, including potential security breaches and software bugs.

- Competition: Ethereum faces competition from other blockchain platforms, and the market landscape is constantly evolving.

Understanding these pros and cons can help you make informed decisions when it comes to trading or investing in Ethereum.

Regulating Ethereum

The regulatory landscape for cryptocurrencies, including Ethereum, is evolving as governments and regulatory bodies seek to establish frameworks to govern the industry. Regulations aim to protect consumers, prevent fraudulent activities, and ensure market stability.

The regulatory landscape for cryptocurrencies, including Ethereum, is evolving as governments and regulatory bodies seek to establish frameworks to govern the industry. Regulations aim to protect consumers, prevent fraudulent activities, and ensure market stability.

Regulations can impact various aspects of the cryptocurrency ecosystem, including exchanges, wallets, initial coin offerings (ICOs), and more. While some regulations may provide clarity and promote investor confidence, overly restrictive regulations could hinder innovation and development.

It’s important to stay informed about regulatory developments in your jurisdiction and comply with any applicable laws when buying, selling, or trading Ethereum.

Where to Buy Ethereum

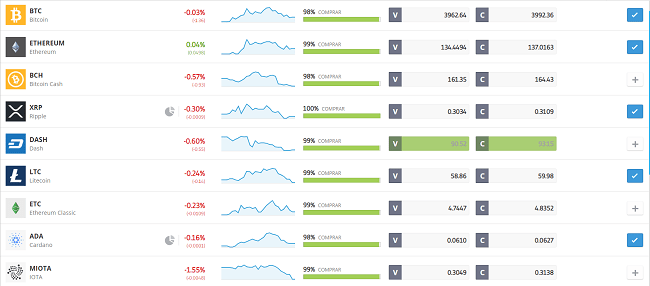

When it comes to buying Ethereum, there are several reputable platforms available. Let’s explore some popular options:

Buy Ethereum with Etoro – Overall Best Trading Platform with 0% Commission

Etoro is a leading social trading platform that has gained significant popularity among cryptocurrency enthusiasts. Founded in 2007, Etoro offers a user-friendly and intuitive interface, making it accessible for both beginners and experienced traders. One of the standout features of Etoro is its social trading functionality, which allows users to interact with and learn from other traders in the community.

With Etoro, you can not only buy and sell cryptocurrencies like Ethereum but also explore a wide range of other financial instruments, including stocks, commodities, and more. The platform provides a seamless and secure trading experience, backed by stringent security measures and regulation.

Etoro offers a variety of tools and features that cater to different trading styles and preferences. Whether you’re a hands-on trader or prefer to follow and replicate the strategies of successful traders, Etoro provides the flexibility to choose the approach that suits you best.

Etoro Fees Table

|

Transaction |

Fee |

|

Ethereum Purchases |

0.75% – 2.90% |

|

Ethereum Sales |

0.75% – 2.90% |

|

Deposit |

Free |

|

Withdrawal |

$5 + 0.1% (minimum $30, maximum $50) |

Pros and Cons of Using Etoro to Buy Ethereum

Pros:

- User-friendly platform with a social trading community.

- Wide range of assets, including cryptocurrencies like Ethereum.

- Secure and regulated platform.

- CopyTrading feature to follow and replicate successful traders.

Cons:

- Fees can be higher compared to other exchanges.

- Limited cryptocurrency withdrawal options.

- Availability may vary depending on the user’s location.

Buy Ethereum with Binance – The best Crypto trading platform

Binance is one of the largest and most reputable cryptocurrency exchanges globally, renowned for its extensive selection of cryptocurrencies and advanced trading features. Established in 2017, Binance quickly gained popularity among traders due to its robust security measures, user-friendly interface, and high liquidity.

As a crypto-to-crypto exchange, Binance focuses on facilitating the trading of one cryptocurrency for another. This means that to buy Ethereum on Binance, you would typically deposit another cryptocurrency, such as Bitcoin, and trade it for Ethereum. Binance offers various trading options, including spot trading, margin trading, and futures trading, catering to different trading preferences and strategies.

Binance is known for its commitment to security and has implemented stringent measures to safeguard user funds. Additionally, the exchange has expanded its services to include features like staking, lending, and even its own cryptocurrency, Binance Coin (BNB).

Binance Fees Table

|

Transaction |

Fee |

|

Ethereum Purchases |

0.10% |

|

Ethereum Sales |

0.10% |

|

Deposit |

Free |

|

Withdrawal |

Network fees apply |

Pros and Cons of Using Binance to Buy Ethereum

Pros:

- One of the largest and most trusted cryptocurrency exchanges.

- Wide selection of cryptocurrencies available, including Ethereum.

- Advanced trading features and options.

- Competitive trading fees.

Cons:

- Binance is primarily a crypto-to-crypto exchange, so you may need to deposit another cryptocurrency to trade for Ethereum.

- Some features and services may be more suitable for experienced traders.

- Binance has faced regulatory challenges in certain jurisdictions, which may affect its availability.

Buy Ethereum with Capital.com – Popular Stock CFD with Great Trading Tools

Capital.com is a popular online trading platform that offers a wide range of financial instruments, including cryptocurrencies like Ethereum. Founded in 2016, Capital.com has gained recognition for its user-friendly interface and comprehensive trading tools.

The platform is designed to provide traders with a seamless and intuitive trading experience. Capital.com offers a range of features, including advanced charting tools, educational resources, and an AI-powered trading assistant that provides real-time insights and personalized recommendations.

Capital.com allows users to trade Ethereum and other cryptocurrencies with competitive spreads and no commission fees. The platform’s focus on user experience, combined with its commitment to regulation and security, has made it a trusted choice for traders looking to access the cryptocurrency market.

Remember, when choosing a platform to buy Ethereum, it’s important to consider factors such as user experience, security, fees, available trading options, and regulatory compliance. Conducting thorough research and comparing different platforms will help you find the one that aligns with your trading needs and preferences.

Capital.com Fees Table

|

Transaction |

Fee |

|

Ethereum Purchases |

Spread (variable) |

|

Ethereum Sales |

Spread (variable) |

|

Deposit |

Free |

|

Withdrawal |

Free |

Pros and Cons of Using Capital.com to Buy Ethereum

Pros:

- User-friendly trading platform with a range of financial instruments.

- Access to various markets, including cryptocurrencies.

- No commission fees on trades.

- Advanced trading tools and analysis features.

Cons:

- Spread fees may apply, which can impact the overall cost of trading.

- Availability may vary depending on the user’s location.

- Limited withdrawal options for cryptocurrencies.

These platforms are well-known and trusted within the cryptocurrency community, but it’s important to conduct your own research and choose the platform that best aligns with your needs, preferences, and regulatory requirements.