Online trading has emerged as a popular and accessible way for individuals to participate in financial markets, manage their investments, and potentially grow their wealth. If you’re new to the world of “Understanding Online Trading,” this article provides a beginner’s overview to help you grasp the basics.

What Is Online Trading?

Online trading is the process of buying and selling financial assets, such as stocks, bonds, commodities, currencies (forex), and cryptocurrencies, through online platforms provided by brokers.

Unlike traditional methods, where you’d need to work through intermediaries or visit physical stock exchanges, online trading allows you to execute trades from the comfort of your computer or mobile device.

Key Components of Online Trading:

- Online Trading Platforms: To get started, you’ll need access to a reliable online trading platform offered by a brokerage firm. These platforms are user-friendly and provide essential tools for executing trades, conducting analysis, and tracking your investments.

- Assets for Trading: Online trading offers a wide range of assets to trade, depending on your interests and risk tolerance. These assets can include stocks, currencies, commodities, indices, and more.

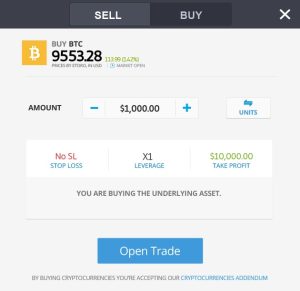

- Orders and Execution: In online trading, you place orders to buy or sell assets. Market orders execute immediately at the current market price, while limit orders allow you to specify the price at which you want to buy or sell an asset.

- Research and Analysis: Successful traders often rely on research and analysis to make informed decisions. This includes technical analysis (studying charts and patterns), fundamental analysis (evaluating the financial health of companies or assets), and sentiment analysis (gauging market sentiment).

- Risk Management: Managing risk is crucial in online trading. Strategies like setting stop-loss orders (predefined price levels to limit losses) and diversifying your portfolio can help protect your capital.

Advantages of Online Trading

- Accessibility: Online trading is accessible to anyone with an internet connection and a computer or smartphone.

- Lower Costs: Online trading typically has lower fees and commissions compared to traditional methods, allowing traders to keep more of their profits.

- Real-Time Information: Online traders have access to real-time market data and news, enabling them to make timely decisions.

- Control: Traders have full control over their investments, with the ability to buy and sell assets at their discretion.

Getting Started with Online Trading

- Educate Yourself: Before diving in, take the time to learn about the financial markets, trading strategies, and risk management.

- Select a Reliable Broker: Choose a reputable online trading broker that offers the assets and features you need. We recommend considering eToro as the best selection, known for its reputation and comprehensive offerings that align with your trading requirements.

- Practice with a Demo Account: Many brokers offer demo accounts where you can practice trading with virtual money to gain confidence.

- Start Small: Begin with a small amount of capital to minimize risk while you gain experience.

- Stay Informed: Continuously update your knowledge by reading financial news, attending webinars, or taking online trading courses.

Post Views: 99