Note: Before reading this article!

We always strive to provide our customers with the latest news and information about finance, stocks and cryptocurrencies. However, we would like to point out that YOU SHOULD NOT take any content on our site as financial advice.

Capital.com review – Who founded Capital.com?

Capital.com was founded by Viktor Propokenya, a 1983-born European technology buff and venture investor. He founded his first business, Viaden Media, in 2001 and eventually sold it in 2011. After that he launched his own investment company, VP Capital, which also includes the fintech company Capital.com among others.

Capital.com was launched in 2016 and stood out due to its implementation of AI in financial tools for trading online. By 2021 the company was valued at approx. 100 Million Dollars, making it one of Viktors’ most successful companies and putting him at a total net worth of approx. 400 Million dollars.

The trading platform was launched on the 7th of April 2016, after receiving a Series A funding of about 25 Million Dollars. A CySec license was acquired exactly one year later, on the 7th of April 2017.

Only three months later, in July of 2017 the company launched a mobile app, allowing traders to do their business on the go. Though back then the mobile app wasn’t able to use the well-known AI feature SmartFeed, a feature we’ll discuss later in this article. A desktop platform was launched in October of 2017 in cooperation with UMSTEL, which is a technology provider regulated by the aforementioned CySec. A month later, in November of 2017, the popular SmartFeed feature was implemented into the platform. In our capital.com app review, we found that another app called Investmate was launched alongside it, acting as a source of educational materials and tools for new traders.

Capital.com review – Is the platform regulated?

In our Capital.com trading review, we found out that capital.com has multiple licenses from various well-known regulation authorities, making it one of the safest and most professional platforms that offer crypto trading. In England and Wales the company is registered under the company registration number 10506220 and regulated by the Financial Conduct Authority (FCA).

In our Capital.com trading review, we found out that capital.com has multiple licenses from various well-known regulation authorities, making it one of the safest and most professional platforms that offer crypto trading. In England and Wales the company is registered under the company registration number 10506220 and regulated by the Financial Conduct Authority (FCA).

In Cyprus the company is registered as Capital Com SV Investments Limited under the company registration number HE 354252. It’s regulated by the Cyprus Securities and Exchange Commission (CySEC).

In Australia the company is known as Capital Com Australia Pty Ltd and registered under the number ABN 47 625 601 489 and regulated by the Australian Securities and Investments Commission (ASIC).

Last but not least another company by the name of Capital Com Stock and CFD Investing Ltd is registered under company number 8429903-1 in Seychelles. Here it is regulated by the Financial Services Authority (FSA).

As you can see, Capital.com has a lot of licenses across the board, making it a very trustworthy platform.

Capital.com review – Is this broker available in USA?

Yes, Capital.com count with the Financial Conduct Authority in the UK, the Securities and Exchange Commission in Cyprus, the FSA, and ASIC. It accepts clients from around the world, with the notable exception of the US.

Capital.com review – SmartFeed Feature

SmartFeed is a feature that monitors user behaviour and analyzes user trades and biases. The AI uses that information to support the trader, potentially preventing them from obvious mistakes as well as providing information, helping the user predict trading outcomes.

It’s also used for educational purposes, analyzing trading patterns in order to help new traders understand, why a certain trade may not be a good choice. Capital.com has also requested a patent for its SmartFeed feature.

Capital.com review – What distinguishes Capital.com from other platforms?

One thing we noticed during our Capital.com crypto review was, that this trading platform stands out from other platforms due to its fast growth, the sheer amount of markets the user has access to as well as its SmartFeed Feature. As mentioned before, SmartFeed will help both new and old traders a lot, ensuring they will make obvious mistakes less often.

On top of that the platform has great customer support, rather low fees, especially in terms of Forex CFD trades as well as a rather intuitive interface. Opening up an account is quick and easy, making the whole trading experience rather smooth.

Pros:

Cons

Capital.com review – Customer service

The capital.com customer support is among the best across all platforms we have reviewed so far. There’s 24/7 live support via live chat and the responses are generally very fast. The customer staff is also quite knowledgeable, so you’ll usually get the answer you’re looking for in no time.

The capital.com customer support is among the best across all platforms we have reviewed so far. There’s 24/7 live support via live chat and the responses are generally very fast. The customer staff is also quite knowledgeable, so you’ll usually get the answer you’re looking for in no time.

Aside from the live chat, you can also contact customer support via email and phone. For email you can contact support at: [email protected]

For phone, you have two choices. You can either call the UK office on +44 20 8089 7893 or the Cyprus office on +357 25 262045.

All in all, the customer support was extremely good and there really haven’t been any negatives we’ve found with it.

Capital.com review – Easy-to-use platform

One of the things we can’t mention often enough is just how intuitive the platform is. It’s quite easy to navigate through the interface and the platform offers a lot of content aimed at new traders.

You’ll even find a video guide on the website. That way you can easily learn to use the platform in a step-by-step fashion through the help of a digital medium instead of having to read through blocks upon blocks of text. Overall there are 15 video guides, all showing you different parts of the trading experience. On top of that, you also have access to 8 video guides explaining the different account settings.

Capital.com review – Fees

The trading fees are always one of the most important aspects of a trading platform, especially in the crypto space, where every bit of costs saved can mean the difference between profits or losses.

Luckily, a lot of the services on Capital.com do not require a few as would be the case for some of its competitors. This crypto trading platform instead earns most of its money from spread fees. That is the difference between the buy and sell prices when you open a new trading position. Hence why it is called “spread”.

Here’s a small overview of the fee structure:

| Service | Fee | Description |

| Withdrawal | Free | Withdrawals are free |

| Deposit | Free | Deposits are free |

| Spread | Varies | Check the live spread information of the financial instrument on the website. |

| Overnight fee | Varies | For cryptocurrencies and shares, the fee is based on leverage only.

For Indices, Commodities, and FX the fee is based on the entire value. |

Capital.com review – Payment methods of Capital.com

Overall the available payment methods for the Capital.com crypto trading platform are one of the low points of the platform. While most of the well-known payment methods are available, the selection is still rather small compared to other platforms.

The website also does not list the USA as an available country for most payment methods aside from Credit Card/Debit Card payments and Bank transfers, so we’d highly suggest asking about the other payment options first before using them

Here’s an overview:

| Method | Timeframe | Currencies | Min. deposit | Withdrawal available? | Additional information |

| Credit Card/Debit Card | Instant | USD, GBP, EUR and AUD | 20$ | Yes | Cards available: Visa, MasterCard and Maestro |

| PayPal | Instant | USD, GBP, EUR and AUD | 20$ | Yes | You must have a PayPal account with funds, in order to use this option. |

| Neteller | Instant | USD, GBP, EUR | 20$ | Yes | You need to have an active account on Neteller |

| Skrill | Instant | USD, GBP, EUR | 20$ | Yes | You need to have an active account on Skrill |

| Bank transfer | 4-7 days | USD, GBP, EUR | 250$ | Yes | Please note down the Transaction ID to prevent delays in crediting the funds.

If possible, transfer funds to the bank account in the same currency as your own bank account (USD, EUR or GBP), to avoid unnecessary bank charges |

| Trustly | Instant | GBP, EUR | 20$ | / | You don’t need to register, but you’ll need access to your online banking. |

Capital.com review – MetaTrader4

Even though capital.com is not using MetaTrader5 yet, it’s still offering the slightly older model MetaTrader4. MetaTrader4 is a rather helpful trading tool that comes with real-time charts, live quotes and a plethora of other trading management tools such as in-depth analytics, indicators and expert advisors.

This will enhance your trading experience quite a bit, giving you the edge over other platforms. You can even use the automated trading feature and have access to 85 pre-installed custom indicators, giving you a better overview of the market situation and allowing you to make informed decisions before every trade.

Capital.com review – TradingView

Capital.com has also partnered up with another very popular platform called TradingView. This website allows you to use capital.com to trade directly from within the live charts displayed on TradingView.

This makes trading even easier, as you can see every little change within a chart in real-time, allowing you to use your whole experience as a trader to the fullest.

Capital.com review – What can I trade on this platform?

- 5782 stocks are available on Capital.com, giving you access to a lot of popular company stocks such as Tesla, Nvidia, Netflix or Amazon. Practically every prestigious company is on offer on capital.com, making it a great platform to diversify your portfolio.

- 27 indices are ready to be invested into. In case you don’t know what indices are, they are basically a group of company stocks put together, such as US’ Nasdaq, the German Dax, or the Dow Jones. So in essence, you will be trading on the fall or rise of a combination of stocks.

- 490 cryptocurrencies can be traded on Capital.com, making it one of the biggest selections of cryptocurrencies available on a single platform. Of course, you’ll also be able the most popular coin Bitcoin, as well as other great coins like Ethereum or Ripple.

- 47 commodities can be found on capital.com such as crude oil or natural gas, with the latter probably being a good investment given the current political landscape.

- 138 Forex assets are also available on capital.com, in case you’re interested in delving into Forex trading as well.

Capital.com review – How to trade using TradingView?

To trade spot on Capital.com you need to follow these simple steps:

- Login to your TradingView account, then go to charts and finally to the trading panel section.

- Select Capital.com and click continue

- If you haven’t done so yet, register at capital.com and log in. Afterwards you can enable TradingView by clicking on the authorization button.

- If you’re not fast enough with your login, you may be timed out. In that case, just reconnect and try it again.

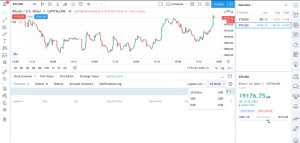

- Once you’ve logged in you’ll be greeted by different tabs: Positions, Orders, History, Account Summary and Notifications log.

- In the top right corner you’ll be able to change your currencies and pick the one you want to use for your trades.

- You will also find a dropdown list there, allowing you to disconnect or switch brokers.

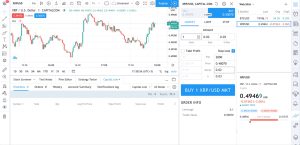

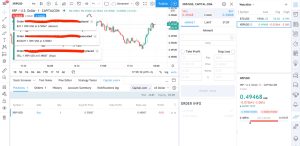

- If you want to trade a specific market using Capital.com you can add it to your list as shown in the image below.

- Once you’ve found your favourite market to trade in you can place an order and add details, as seen below. You can also specify stop loss or take profit limits.

- You will receive a notification once your position has been created.

Capital.com review – Conclusion

We have spent a lot of time trying out all the different features of the Capital.com crypto trading platform and overall we’ve been very pleased with how good the platform turned out to be.

In terms of accessibility, it’s one of the best platforms we’ve used and we highly recommend it for new traders in particular. The amount of educational material, the intuitiveness of the platform and the video guides are a blessing for those that are just getting into trading.

On top of that, you have a massive amount of assets available for trade, a steady partnership with TradingView, access to MetaTrader4 and a fair fee structure.

The platform is also licensed by many different regulation authorities, making it a very trustworthy and secure broker.

The only real downside we found was the limited amount of payment methods, particularly for US citizens. It was also difficult to figure out the maximum deposits available for each payment option, so this should be made clearer in the future.