What is Litecoin?

Litecoin, often referred to as the “silver to Bitcoin’s gold,” is a peer-to-peer cryptocurrency that was created by Charlie Lee in 2011. It was designed to offer a faster and more scalable alternative to Bitcoin. Similar to other cryptocurrencies, Litecoin operates on a decentralized network, using blockchain technology to enable secure and transparent transactions.

Litecoin History

Litecoin has a fascinating history that is worth exploring. It was one of the early cryptocurrencies to be launched after Bitcoin, and its creation aimed to address some of Bitcoin’s limitations. Over the years, Litecoin has gained significant popularity and has established itself as one of the leading cryptocurrencies in the market.

Price History

The price history of Litecoin has witnessed both highs and lows. Like other cryptocurrencies, Litecoin’s price is subject to market fluctuations and investor sentiment. Understanding the price history of Litecoin can provide valuable insights for making investment decisions.

How does Litecoin work?

Litecoin operates on a peer-to-peer network, utilizing blockchain technology. It shares many similarities with Bitcoin in terms of its underlying technology but offers certain distinctive features. Litecoin uses a different hashing algorithm called Scrypt, which enables faster block generation and transaction confirmation times. This makes Litecoin transactions quicker and more efficient compared to Bitcoin.

Why Buy Litecoin?

There are several compelling reasons why you should consider buying Litecoin in 2023. Here are some key factors that make Litecoin an attractive investment option:

- Transaction Speed: Litecoin’s faster block generation time allows for quicker transaction confirmations, making it more suitable for everyday transactions.

- Scalability: Litecoin’s network has demonstrated its ability to handle a significant volume of transactions, positioning it as a scalable cryptocurrency.

- Active Development: Litecoin benefits from an active development community and continuous improvements, ensuring the currency remains up to date with the latest advancements.

- Wider Adoption: Litecoin has gained widespread acceptance among merchants and online platforms, increasing its usability and value.

Buying Litecoin Safely

When it comes to buying cryptocurrencies, including Litecoin, it is essential to prioritize safety and security. Here are some guidelines to help you buy Litecoin safely:

- Choose Reputable Exchanges: Select reliable and regulated cryptocurrency exchanges that have a track record of secure transactions and user protection.

- Secure Wallet: Use a secure digital wallet to store your Litecoin. Hardware wallets, such as Ledger or Trezor, offer enhanced security features and protect your assets from online threats.

- Two-Factor Authentication: Enable two-factor authentication (2FA) for your exchange and wallet accounts to add an extra layer of security.

- Research and Due Diligence: Before making any investment, thoroughly research the exchange or platform where you plan to buy Litecoin. Read reviews, check for security measures, and ensure the platform aligns with your needs.

Risks of Buying Litecoin

While Litecoin offers promising potential, it’s important to consider the associated risks before making any investment decisions. Some potential risks include:

- Volatility: Cryptocurrencies are known for their price volatility. Litecoin is no exception, and its value can experience significant fluctuations over short periods.

- Regulatory Uncertainty: The regulatory environment surrounding cryptocurrencies is still evolving. Changes in regulations and government policies may impact the adoption and value of Litecoin.

- Technological Risks: While blockchain technology is secure, there are always risks associated with software vulnerabilities, hacks, or network disruptions that may affect Litecoin’s operation.

Is Litecoin a Good Investment?

Determining whether Litecoin is a good investment depends on various factors, including your investment goals, risk tolerance, and market analysis. While Litecoin has shown potential, it is crucial to conduct thorough research and seek professional advice before making any investment decisions.

Litecoin Price Prediction

Predicting the future price of any cryptocurrency, including Litecoin, is challenging due to the volatile nature of the market. Numerous factors, such as market demand, technological advancements, and regulatory changes, can influence the price. It is advisable to consider multiple sources of information and perform your own analysis before forming price predictions.

Litecoin Pros and Cons

Before investing in Litecoin, it is essential to evaluate its pros and cons. Here are some key points to consider:

Pros of Trading with Litecoin:

- Fast transaction confirmations

- Strong development community

- Wider adoption and usability

- Lower transaction fees compared to traditional financial systems

- Scalable network capable of handling a significant volume of transactions

Cons of Trading with Litecoin:

- Price volatility and market fluctuations

- Regulatory uncertainty

- Technological risks and potential vulnerabilities

- Dependency on market sentiment and investor demand

Regulating Litecoin

The regulatory landscape for cryptocurrencies, including Litecoin, continues to evolve. Governments and regulatory bodies are developing frameworks to address concerns related to money laundering, consumer protection, and market stability. Staying informed about regulatory developments is crucial for Litecoin investors to understand the potential impact on their investments.

The regulatory landscape for cryptocurrencies, including Litecoin, continues to evolve. Governments and regulatory bodies are developing frameworks to address concerns related to money laundering, consumer protection, and market stability. Staying informed about regulatory developments is crucial for Litecoin investors to understand the potential impact on their investments.

Where to Buy Litecoin

When it comes to buying Litecoin, several platforms offer convenient options. Here are three popular platforms worth considering:

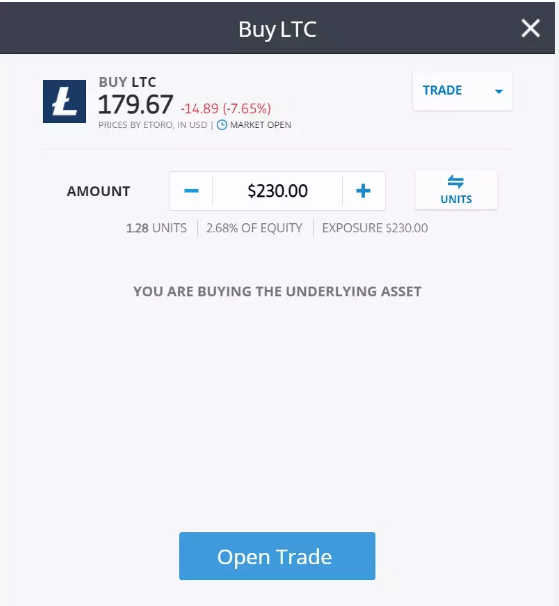

Etoro – Overall Best Trading Platform with 0% Commission

Etoro is a renowned social trading and multi-asset brokerage platform that allows users to invest in cryptocurrencies, stocks, commodities, and more. It provides a user-friendly interface, extensive educational resources, and a wide range of trading tools.

Etoro Fees Table

|

Transaction Type |

Fee |

|

Buy Bitcoin |

0% |

|

Sell Bitcoin |

0% |

|

Deposit |

$0 |

| Withdrawal |

$5 |

Pros and Cons of Using Etoro to Buy Litecoin

Pros:

- User-friendly interface suitable for beginners

- Extensive educational resources and social trading features

- Regulated and reputable platform

- Availability of multiple payment methods

Cons:

- Higher spread compared to some other exchanges

- Limited selection of cryptocurrencies available for trading

Binance – The best Crypto trading platform

Binance is one of the largest and most popular cryptocurrency exchanges globally. It offers a wide range of cryptocurrencies for trading, including Litecoin. Binance provides a robust trading platform, advanced trading features, and a high level of liquidity.

Binance Fees Table

|

Transaction Type |

Fee |

|

Buy Bitcoin |

0.1% |

|

Sell Bitcoin |

0.1% |

| Deposit |

Free |

| Withdrawal |

Varies |

Pros and Cons of Using Binance to Buy Litecoin

Pros:

- Wide selection of cryptocurrencies available

- Advanced trading features and charting tools

- High liquidity and competitive fees

- Strong security measures

Cons:

- Limited fiat currency support

- More suitable for experienced traders

Capital.com – Popular Stock CFD with Great Trading Tools

Capital.com is a popular online trading platform that offers a range of financial instruments, including cryptocurrencies such as Litecoin. It provides users with a seamless trading experience, combining a user-friendly interface with advanced trading tools.

Capital.com Fees Table

|

Transaction Type |

Fee |

|

Buy Bitcoin |

0% |

|

Sell Bitcoin |

0% |

| Deposit |

Free |

| Withdrawal |

Free |

Pros and Cons of Using Capital.com to Buy Litecoin

Pros:

- Intuitive and user-friendly platform

- Competitive spreads and transparent pricing

- Access to a wide range of financial instruments

- Free withdrawals

Cons:

- Limited cryptocurrency selection compared to dedicated exchanges

- No support for direct cryptocurrency deposits or withdrawals