Welcome to our comprehensive review of the best stock trading platforms. Discover top options for investing in today’s dynamic markets.

What are shares?

Shares are units in one or more companies whose holder, who is the shareholder, is entitled to a share of the company’s profits in the event that dividends are paid, as well as voting rights if granted by the company.

How do the shares work?

Shares are part of the market and in English, they are simply called “stocks” or “shares”, which are understood as units of ownership in a company.

Depending on what shares you buy they can go up in value or go down in value, which is why the stakes are so volatile. However, you can also bet against a market or a company, so you could even profit from a downswing. Also, stock exchanges facilitate the exchange of publicly traded shares, the most common way of doing this being when a so-called initial public offering is made.

Why invest in stocks?

The question is rather: who should you trust when it comes to your investment? We will show you the best brokers you can trust. In this guide, we’re going to show you some of the best platforms for trading stocks, and we especially recommend one of the best, which is eToro: a secure, professional and zero-commission platform. Their reviews so far don’t disappoint! Is it worth it? People think that buying stocks is difficult and uncertain, but it’s not. Buying shares can be very easy, the hard part is being able to buy them at the right time. We tell you all about it in detail below. Read on to find out more.

Top 10 Best Stock Platforms to invest in 2023

- BioNTech

- Modern

- Apple

- Amazon

- Microsoft

- Tesla

- Gamestop

- Nio

Best Stock Platforms – Using investment platforms

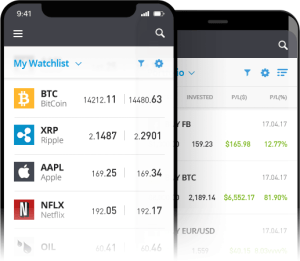

More and more people in the US are becoming encouraged to invest in the stock market. However, the market is rather volatile, so you can never be too sure when it comes to investing! But despite that, you’ll be pleasantly surprised when you put in some work. On the eToro investment stocks platforms, for example, you can experience results quickly and easily, without being a master of finance. You can create a portfolio where you can invest in a wide range of stocks, watch your earnings results rise and fall on advanced charts and make money from the comfort of your couch at home.

There are also excellent analysis tools to create customized watch lists to keep you informed at all times with a staking service where you can grow your virtual wallet. Other platforms to buy stocks we are going to show you are Capital.com, Libertex and Binance. They all

deserve your attention, but the one we always recommend will be eToro, and now you’ll know why, read on!

eToro Platform – The Best Platform in 2024

eToro offers its investors an enviable experience. With this platform, you can open a portfolio where you can invest in any company you want, or you can see the upward or downward trend of your favourite cryptocurrencies on advanced charts with excellent analysis tools.

We highly recommend this social platform because it has more than 15 million users worldwide and never disappoints! Among its advantages is the ability to buy stocks without commissions, the eToro Wallet, an e-wallet where you can use platforms to invest in stocks, store cryptocurrencies and trade CFDs. So if you’re looking for the best platforms to buy an sell stocks, look no further.

What makes eToro the best platform in 2024?

Pros of using eToro

- Easy-to-use trading platform.

- Shares without paying commissions or trading expenses.

- More than 2,000 stocks and more than 250 funds are listed on 17 international markets.

- Cryptocurrencies, commodities and currencies.

- Funds by debit/credit card, e-wallet or bank account.

- Possibility of copying other users’ operations.

- Regulated by the FCA, CySEC, and ASIC and registered with FINRA.

Cons of using eToro

- It is not suitable for advanced traders who like to perform technical analysis.

Why buy stocks on eToro?

- It is cheaper than other trading platforms, without a doubt. You can buy on the spot, the platform charges zero commissions and has no hidden fees.

- You can use a demo before you buy. eToro offers you the option to access your virtual wallet to simulate trades and transactions that are based on real financial market data.

- As you have seen, the interface is the simplest of all. The portal has a very intuitive platform, which will make it easy for you to buy and sell without effort or headaches, and all instantly and easily.

- You can learn from other users or traders. It is a leader as a social trading platform, as it keeps its different channels active for its community, a bit like the Bitcoin.org platform itself.

Best Stock Platforms - What are my options for investing in eToro?

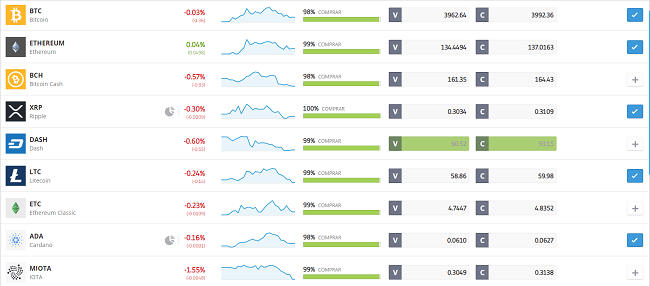

- Cryptocurrencies

With eToro you will be able to invest in cryptocurrencies at unique rates to store them with eToro Wallet, which allows you to send and receive cryptocurrencies from other wallets. Another feature is “staking” where you can receive rewards for holding your crypto assets.

- Forex or foreign exchange market

At eToro you will have 49 currency pairs to trade, but don’t forget that this is a market with high price volatility. Also, at eToro, you can trade the most traded currencies in the

market: EUR/USD, GBP/USD, USD/CAD… among others, to create a diversified portfolio.

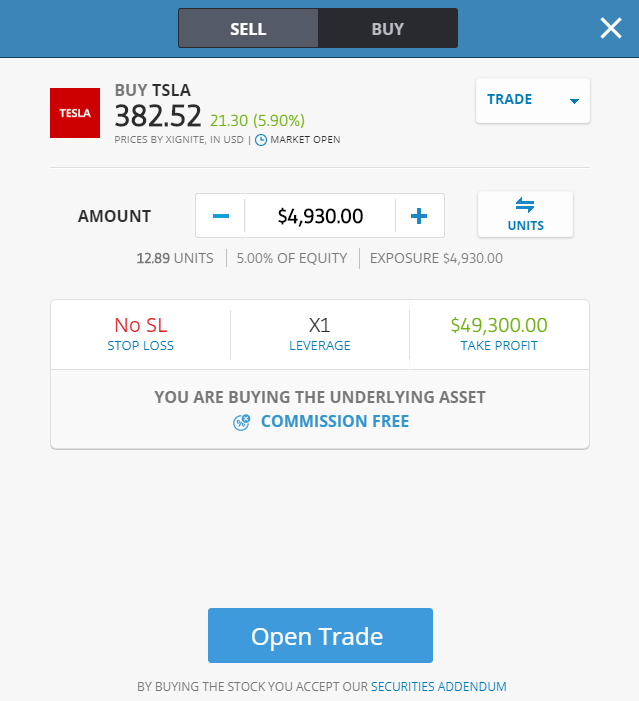

- Commission-free shares

eToro offers the possibility to invest in thousands of shares with 0% commissions for buying and selling shares of companies such as Google, Amazon, Facebook or Apple.

- Raw materials

On eToro you can trade more than 30 different commodities including gold, silver, palladium, cocoa, cotton and oil.

- Indexes

Index trading can provide your portfolio with great diversification. With eToro you can trade 50 different indices through CFDs and trade on the rise and fall of market prices.

- ETFs

ETFs have grouped sets of assets created by experts to trade as one. At eToro you can invest in over 250 different ETFs. These ETFs can be grouped by geographic area, sector or asset type (industry, video games, financials…).

Best Stock Platforms - The state of the current market

A year always begins with hopes, new ideas and resolutions, and for this year 2023, banks, management companies and firms have already presented their first results to start the year. Calculations are already being made of the comparative potential of each company and at present, inflation, the crisis in the supply chain, the policies of the banks or even the Asian countries are some of the factors that can predict high or low forecasts according to the experts.

The goal and purpose of this year for investors is not to wait for stocks to give great returns as before the pandemic, although a profit of 4% is expected in each of the markets.

How to take advantage of low prices

Price declines can be seen as opportunities to buy assets and stocks on the best stock platforms with a view to the long term, although the outlook is much better. A downturn is now being seen with the Russia-Ukraine war, and markets are interspersed with bullish and bearish periods of varying magnitude.

No one knows precisely when and how it will come, but big changes are expected. It could be that stock prices continue to fall in a downtrend or that they suddenly change their minds and take longer but eventually prices correct and reach neutral values again.

We must also accurately analyze the results and historical behaviour of the companies to have an idea about the probability of fluctuation and volatility of the stocks we choose.

Factors to Look at in the Best Stock Platforms

In order to find the right stock trading platform for your needs, you should take a moment and think about which of the factors are most important to you. Do you need access to a lot of different cryptocurrencies and assets, or are you fine with a rather sparse selection?

Safety and security may also be one of your main priorities, in which case you should look for a platform that is regulated and back by a fond, to ensure your money is not at risk, should the company go under.

We have listed a few factors, which you should keep in mind when looking for a trading platform that meets your requirements.

Best Stock Platforms - Regulation

A trading platform should, in the best case scenario, be regulated by any of the big regulating authorities. One of the most well-known regulating body is the CySec, the Cyprus Securities and Exchange Commission.

A trading platform should, in the best case scenario, be regulated by any of the big regulating authorities. One of the most well-known regulating body is the CySec, the Cyprus Securities and Exchange Commission.

Most of the best platforms to invest in stocks are regulated by CySec. There’s also the Securities and Exchange Commission (SEC), which is based in the US.

Best Stock Platforms - Assets

Assets are most widely known as stocks and are typically owned by either a person or a company. They have a monetary value that can be measured directly and it’s what most traders are used to.

By buying assets you can basically own a part of a company and sometimes companies will also offer dividend payouts for their investors. A good trading platform should offer a wide variety of assets.

Shares or Traditional CFDs

Unlike regular assets, shares and CFDs practically describe a fraction of an asset. In this case the “buyer” doesn’t actually become the owner of the asset or the company, instead he basically becomes the holder of a claim, or a debt if you will.

Shares and CFDs are very speculative in nature, and thus trading them can be a huge risk for your capital. As such, these should be traded by experienced traders only. A good platform should have a big selection of shares and CFDs

Payment methods

When you’re looking for a good trading platform, you should check whether or not the platform offers the payment methods you’re looking for. The worst thing is spending several hours researching different best platforms to buy stocks, only to end up picking the wrong one and realizing you can’t even make a deposit. This should probably be one of the first things to check when looking for a platform.

Customer Support

Customer support is quite an important factor when considering whether or not to join a trading platform. You want to ensure, that the trading platform of your choice has good customer service. No one wants to wait for hours upon hours when dealing with an issue. This is your hard-earned money after all, so any issues should be dealt with swiftly.

Customer support is quite an important factor when considering whether or not to join a trading platform. You want to ensure, that the trading platform of your choice has good customer service. No one wants to wait for hours upon hours when dealing with an issue. This is your hard-earned money after all, so any issues should be dealt with swiftly.

Make sure to read some customer reviews, to figure out whether or not the customer support meets your expectation.

Best Stock Platforms - Fees

The fee structure is among the most important factors when looking for a good trading platform. Both the trading and withdrawal fees should, preferably, be quite low. Every trade and withdrawal will cost you money, so the less fees you have to pay, the better.

You should also check for other fees, such as inactivity fees when you don’t use your account for a while. Many platforms will ask for a fee during your absence, so make sure the fee is low.

Best Stock Platforms - Trading Tools & Features

This is a very important factor for both new and veteran traders. You should take a look at each platform and see if they have trading tools and features that can help you with your trades. From copy trading to stop loss functions and more, all of these can help you become a better trader.

Best Stock Platforms - Demo availability

Some trading platforms for stocks will offer a demo account, which allows you to trade in a completely risk-free environment. This is especially helpful for new traders, as it helps you take your first steps as a trader without risking your money straight away. But it’s also helpful for veteran traders, as it’ll allow you to get used to the platform first, before investing your money.

Education, Research & Analysis

This topic is particularly important if you’re a new trader. While veterans can always learn more, a new trader really profits a lot from a platform that offers educational materials. It will help you learn how to properly research and analyze cryptocurrencies and assets, allowing you to become an experienced trader in no time.

Mobile App

This factor is important for traders that like to do their business on the go. If you’re more used to making trades via your smartphone instead of your pc, then you should definitely check whether or not the platform has a proper mobile app.

Some platforms to trade stocks offer rather poor mobile apps, that either won’t work properly or the design will look awful, as it’s not optimized for mobile phones. Make sure that your trading platform of choice has a good mobile app if you wish to trade while on the go.