What is Chainlink?

Note: Before reading this article about buy Chainlink!

We always strive to provide our customers with the latest news and information about finance, stocks and cryptocurrencies. However, we would like to point out that YOU SHOULD NOT take any content on our site as financial advice.

Chainlink History

Chainlink is a decentralized oracle network that bridges the gap between smart contracts and real-world data. It was founded in 2017 by Sergey Nazarov and Steve Ellis. Since its inception, Chainlink has gained significant attention and adoption within the blockchain industry.

Price History

Over the years, Chainlink has witnessed remarkable growth in its price. From its initial launch, the value of Chainlink tokens has surged, making it one of the most profitable cryptocurrencies in the market. However, as with any investment, it’s important to consider the volatility and potential risks associated with price fluctuations.

How Does Chainlink Work?

Chainlink functions by connecting smart contracts with real-world data, enabling them to interact with external systems and APIs. This ensures the accuracy and reliability of data inputs, making smart contracts more robust and secure. The decentralized nature of Chainlink’s oracle network prevents single points of failure and enhances the overall integrity of the system.

Why Buy Chainlink?

There are several compelling reasons to consider investing in Chainlink. Firstly, Chainlink offers a unique solution for smart contract connectivity, filling a crucial gap in the blockchain ecosystem. Its innovative approach and widespread adoption make it a valuable asset in the decentralized finance (DeFi) space.

Additionally, Chainlink has established strong partnerships with leading organizations, including tech giants such as Google and Oracle. These collaborations further validate the potential of Chainlink and enhance its credibility in the market.

Buying Chainlink Safely

When it comes to buying Chainlink, it’s essential to prioritize safety and security. Here are some tips to ensure a safe purchasing process:

- Research and choose reputable cryptocurrency exchanges.

- Set up two-factor authentication for your exchange accounts.

- Securely store your Chainlink tokens in a hardware wallet.

- Regularly update your antivirus software and use secure internet connections.

Risks of Buying Chainlink

While Chainlink presents promising investment opportunities, it’s important to be aware of the risks involved. As with any cryptocurrency investment, there is a degree of volatility and market uncertainty. Prices can fluctuate rapidly, potentially resulting in significant gains or losses.

Additionally, regulatory changes and technological advancements in the blockchain industry can impact the value and performance of Chainlink. It’s crucial to stay informed and make informed investment decisions based on thorough research.

Is Chainlink a Good Investment?

The question of whether Chainlink is a good investment depends on various factors, including your risk tolerance, investment goals, and market conditions. Chainlink has shown substantial growth and has a strong track record, making it an appealing investment option for many.

However, it’s important to conduct your due diligence and seek advice from financial professionals before making any investment decisions. Assessing your financial situation and understanding the cryptocurrency market can help determine if Chainlink aligns with your investment strategy.

Chainlink Price Prediction

Predicting the future price of any cryptocurrency is challenging, as it depends on numerous factors such as market demand, technological advancements, and regulatory developments.

However, many experts and analysts have provided their Chainlink price predictions based on current market trends and the potential growth of the cryptocurrency. It’s important to note that these predictions are speculative and should not be considered as financial advice. Here are some notable Chainlink price predictions for the future:

- Some analysts believe that Chainlink has the potential to reach new all-time highs in the coming years, with price targets ranging from $100 to $200 per LINK token.

- Others are more conservative in their predictions, expecting steady growth but at a slower pace, with price targets around $50 to $100 per LINK token.

- Factors that could contribute to the price appreciation of Chainlink include increased adoption of smart contracts and decentralized finance, expansion of the oracle network, and successful partnerships with major companies.

As with any investment, it’s important to consider multiple factors and conduct thorough research before making any financial decisions. Market conditions can change rapidly, and it’s essential to stay informed and adapt your investment strategy accordingly.

Chainlink Pros and Cons

When considering investing in Chainlink, it’s crucial to evaluate the advantages and disadvantages. Here are some key points to consider:

Pros of Trading with Chainlink:

- Chainlink offers a unique solution for smart contract connectivity, addressing a critical need in the blockchain ecosystem.

- The partnership with reputable companies such as Google and Oracle enhances Chainlink’s credibility and market potential.

- The decentralized nature of Chainlink’s oracle network provides robustness and security to the system.

- Chainlink has demonstrated significant growth and has established itself as a major player in the decentralized finance space.

Cons of Trading with Chainlink:

- The cryptocurrency market is highly volatile, and prices can experience significant fluctuations.

- Regulatory changes and legal uncertainties in the cryptocurrency space may impact the value and performance of Chainlink.

- Competition from other blockchain projects addressing similar challenges could affect Chainlink’s market position.

Regulating Chainlink

Regulation plays a crucial role in the cryptocurrency industry, and it’s essential to consider the regulatory landscape when investing in Chainlink. As governments and regulatory bodies worldwide develop frameworks for cryptocurrencies, Chainlink’s compliance with regulations will be critical for its long-term success and adoption.

Regulation plays a crucial role in the cryptocurrency industry, and it’s essential to consider the regulatory landscape when investing in Chainlink. As governments and regulatory bodies worldwide develop frameworks for cryptocurrencies, Chainlink’s compliance with regulations will be critical for its long-term success and adoption.

It’s important to monitor regulatory developments and ensure that Chainlink adheres to the necessary compliance measures to mitigate potential risks.

Where to Buy Chainlink

If you’re interested in purchasing Chainlink, there are several reputable cryptocurrency exchanges available. Here are three popular platforms to consider:

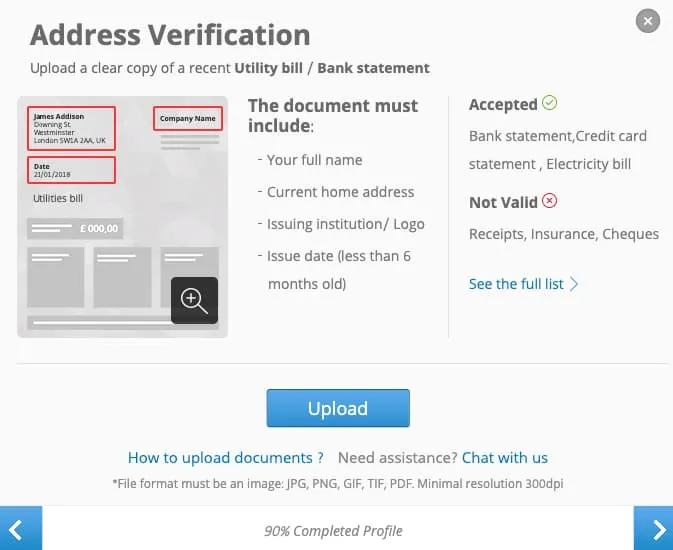

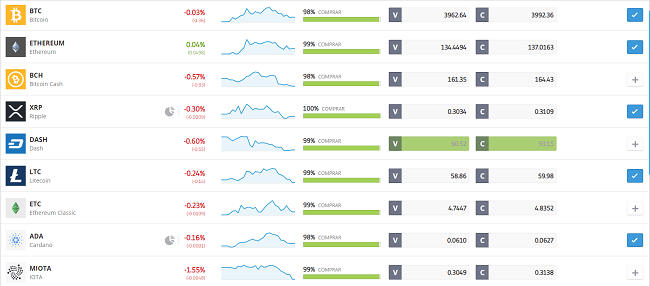

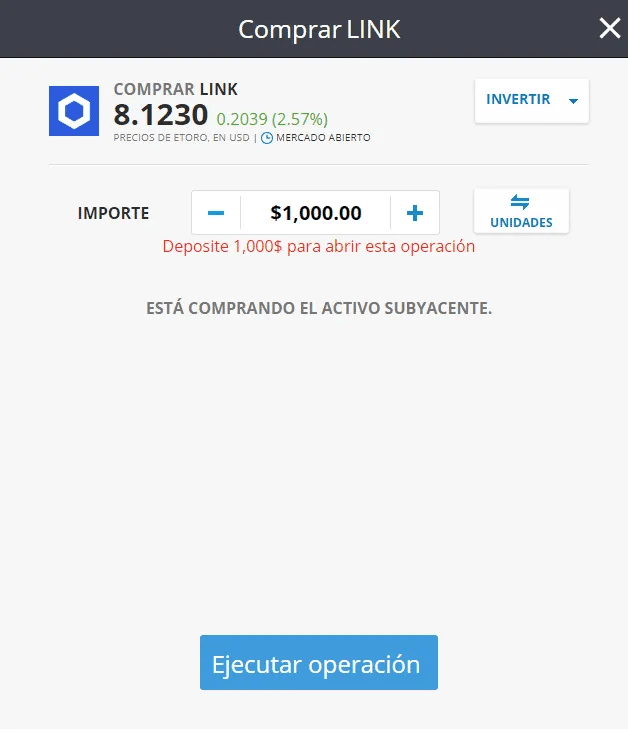

Etoro – A Gateway to the Crypto Market

Etoro is a well-established social trading and investment platform that provides users with a user-friendly interface and access to a wide range of financial instruments, including cryptocurrencies like Chainlink. With its intuitive design and social trading features, Etoro offers a unique trading experience that caters to both beginners and experienced traders.

With over a decade of experience in the industry, Etoro has built a reputation as a trusted and regulated platform for cryptocurrency trading. It offers a variety of features that make it an attractive choice for those looking to buy Chainlink. Etoro’s focus on social trading allows users to learn from and copy the trading strategies of successful traders, making it an appealing platform for beginners seeking guidance.

Etoro Fees Table

| Transaction Type | Fee |

| Buying Chainlink | 1.9% (including spread and commission) |

| Selling Chainlink | 1.9% (including spread and commission) |

Pros and Cons of Using Etoro to Buy Chainlink

Pros:

- User-friendly interface for both beginners and experienced traders.

- Social trading features allow users to interact and learn from other investors.

- Variety of payment methods available, including credit/debit cards and bank transfers.

Cons:

- Limited cryptocurrency options compared to dedicated exchanges.

- Withdrawal fees may apply when transferring funds from the Etoro platform.

Binance – A Leading Crypto Exchange

Binance is one of the largest and most popular cryptocurrency exchanges globally, offering a wide selection of cryptocurrencies for trading, including Chainlink. With its robust trading infrastructure, Binance has gained a strong reputation among cryptocurrency enthusiasts and experienced traders.

As a leading exchange, Binance provides a comprehensive trading experience with advanced features and a diverse range of trading pairs. It offers a user-friendly interface, making it suitable for both beginners and experienced traders. Binance is known for its extensive cryptocurrency offerings, liquidity, and competitive fees.

Binance Fees Table

| Transaction Type | Fee |

| Buying Chainlink | 0.1% trading fee |

| Selling Chainlink | 0.1% trading fee |

Pros and Cons of Using Binance to Buy Chainlink

Pros:

- Extensive selection of cryptocurrencies available for trading.

- Advanced trading features and tools for experienced traders.

- High liquidity, ensuring smooth transactions.

Cons:

- The platform may be overwhelming for beginners due to its advanced features.

- Some features and services are not available for users in certain countries.

Capital.com – Trade Chainlink with Ease

Capital.com is an innovative online trading platform that offers users a seamless and intuitive trading experience across various financial markets, including cryptocurrencies like Chainlink. With its user-friendly interface and advanced trading tools, Capital.com aims to simplify the trading process for both beginners and seasoned traders.

Capital.com combines cutting-edge technology with a user-centric approach to provide traders with an intuitive platform. The platform’s focus on user experience and educational resources makes it an attractive option for those looking to buy Chainlink. Capital.com aims to empower users with the tools and knowledge needed to make informed trading decisions.

Capital.com Fees Table

| Transaction Type | Fee |

| Buying Chainlink | Variable spread (no additional commissions) |

| Selling Chainlink | Variable spread (no additional commissions) |

Pros and Cons of Using Capital.com to Buy Chainlink

Pros:

- Intuitive and user-friendly platform suitable for beginners.

- Access to a wide range of financial instruments, including cryptocurrencies.

- Competitive spreads for trading activities.

Cons:

- Limited cryptocurrency options compared to dedicated exchanges.

- Availability of certain features may vary depending on the user’s location.